Why AI Education Now Matters

As artificial intelligence is rapidly reshaping the world and the financial advice profession. The time it takes for the knowledge required to be an investment adviser representative (IAR), CPA financial planner, or other financial professional is becoming obsolete about every four years, and knowledge obsolescence is accelerating fast. Professionals have no choice but to find meaningful, relevant, and forward-looking, artificial intelligence CE for IARs and CPA CPE. CFP professionals also benefit from AI classes but they don't earn educational credit, as explained below.

A Class Built for Immediate Utility

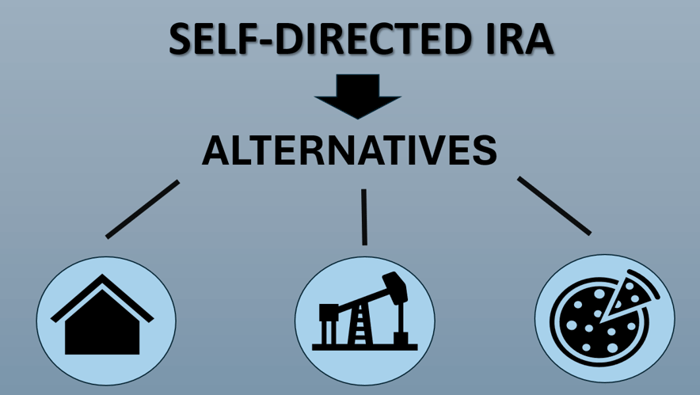

This program is specifically designed for professionals seeking CE credit that not only satisfies regulatory requirements but also enhances their real-world productivity. While many continuing education classes cover static topics, this course focuses on real-time, actionable AI tools and workflows. The goal is simple: help IARs and CPAs save time, improve communication, and strengthen client relationships using artificial intelligence, particularly through platforms like ChatGPT.

Practical Learning Objectives

Much of the CE and CPE sold to practitioners is about knowledge you may not really need to know. For example, much of the tax planning course content sold to financial planners and investment advisers is larded with technical tax details rarely used or deals with premature speculation on the effects of a final tax law before it undergoes the wildly unpredictable reconciliation process in Congress. In contrast, Artificial Intelligence CE for IARs and CPA CPE is likely benefit you immediately after completing this class, which aims to teach you how to:

|

|

|

|

|

|

|

|

|

|

Meet the Instructor, a Prolific Writer and Driven Entrepreneur

Craig Turner, the course instructor, is a serial entrepreneur, former newspaper reporter, and author of nine novels, including a thriller about an AI-generated politician, which he wrote in 2020 -- four years before AI became a really big thing and before he became an AI consultant. Craig has trained thousands of individuals at more than 900 organizations on using AI—including small businesses, not-for-profits, and chambers of commerce—on how to use AI tools to improve operations. In this class, Craig brings his powerful, hands-on teaching style to financial professionals with practical examples and live demonstrations tailored to an advisory space.

AI: A Tool to Empower, Not Replace

From the outset, Craig emphasizes that AI is not a threat to human professionals, but a tool that—when used correctly—can enhance decision-making, accelerate research, streamline compliance, and strengthen marketing. One of the key distinctions he draws is between using AI as a crutch and using it as a tool. He explores what that means in everyday advisory firm workflows, showing how AI can help automate content generation, prepare for client meetings, and even refine messaging for regulatory-compliant communications.

Smarter Prompts, Smarter Results

Key topics include writing smarter prompts, using AI to generate blog and email content, analyzing customer data, and automating routine tasks. The course highlights powerful tools like ChatGPT Plus, custom GPTs, deep research modules, and voice functionality to illustrate how financial advisors can integrate AI into their day-to-day practice. Through real-world financial advisory scenarios, participants learn how to make AI work for them, not replace them.

Compliance-Friendly, Practice-Ready

The course also tackles essential topics for compliance-minded professionals. Craig walks attendees through how to turn off data sharing in paid AI tools to protect client information, a critical topic in a regulated profession. He also demonstrates how AI can help advisors avoid misleading language in advertising, strengthening compliance with SEC and FINRA rules.

Eligible CE Credit for IARs and CPAs

If you 're searching online for Artificial Intelligence CE for IARs and CPA CPE, this course was designed with you in mind. Practice management topics are eligible under NASAA’s Model Rule for IAR CE and under NASBA’s guidelines for CPA CPE in most states.

CFP and CIMA? Read This First

It is important to understand that not all professional certification regulatory bodies treat practice management education topics the same way. The CFP Board, for example, does not grant CE credit for practice management courses. The Investments & Wealth Institute (IWI), which governs the CIMA and CPWA credentials, generally follows the CFP Board’s approach to CE credit. Therefore, although this course will be submitted to the CFP Board for review, it is unlikely to qualify for CE credit for CFPs or CIMAs. We believe the value is still substantial for learning and growth.

A Test Of CFP Board Policy

The CFP Board's policy on this issue is that a program must directly contribute to the knowledge, skills, and abilities that are essential for a CFP® professional to provide competent and ethical financial planning to clients. While practice management content—such as tools for optimizing research processes or improving efficiency—can be valuable, it generally does not qualify for CFP Board CE credit. That is, unless the focus is clearly tied to client-facing financial planning competencies, such as enhancing the quality of financial advice through AI-driven research tools, Improving investment analysis directly used in financial planning recommendations, or shows how to use AI to strengthen communication strategies with clients in support of financial planning decisions. This class, Artificial Intelligence CE for IARs and CPA CPE, would seem to meet the CFP Board's requirements. We will update this post to let you know if this class receives approval from CFP Board.

CE Credit That Actually Builds Skills

That said, for IARs and CPAs, this course offers immense value. It helps you meet CE requirements while also delivering practical tools you can apply immediately. Whether you're a solo advisor, part of a team, or a forward-thinking CPA, you’ll gain insight into how AI can reshape your practice for the better. And the session is led by someone who uses AI daily—not just to teach it, but to grow his own consulting business.

AI + CE = Competitive Advantage

Whether you’re researching artificial intelligence CE for IARs and CPA CPE or exploring new ways to modernize your financial services business, this course is a smart move. It's a rare blend of compliance-friendly content and practical innovation—two things that rarely go hand in hand. And with regulatory and client expectations evolving fast, staying ahead of the curve has never been more important.

Conclusion: Elevate Your Practice with AI Education

If you’re ready to earn credit, build your competitive edge, and explore what AI can do for your financial advisory practice, this course delivers. Artificial intelligence CE for IARs and CPA CPE isn’t just a trending search phrase—it’s a new standard for professional excellence.