Best CFP CE in 2025 Marks a Turning Point

Why This Is the Best CFP CE in 2025

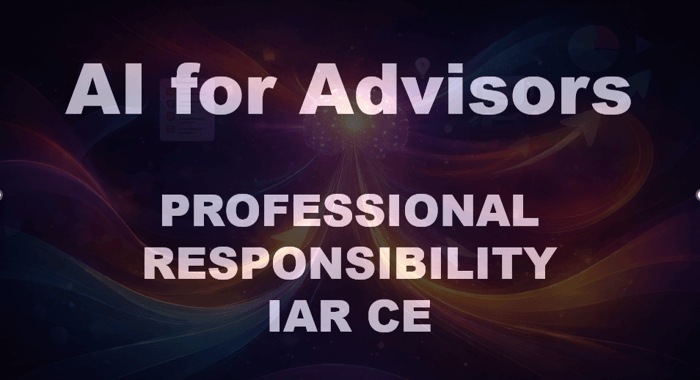

“Artificial Intelligence for Financial Advisors LIVE!” taught by Craig Turner on July 10, 2025, not only breaks new ground by covering practical AI techniques for planners, but it also demonstrates that technology-focused practice management classes can qualify for CE credit, even if they don't teach CFP professionals about financial planning. That is a big deal for CFPs, who want their CE hours to be directly relevant to modern practice. Which is why this class is among the best CFP CE in 2025.

For years, the CFP Board maintained a strict stance: CE classes had to tie directly to its Principal Knowledge Topics, covering areas like investment planning, estate strategies, or retirement distributions. Historically, topics like practice management, marketing, or technology were almost always rejected for credit, unless they could be explicitly tied to the financial planning process. As a columnist for Investment Advisor magazine and Financial Advisor magazine, “The Gluck Report” occasionally detailed how these exclusions frustrated advisors eager to build tech skills, which were growing crucial to providing clients the best advice but received no CFP CE recognition.

How Craig Turner’s Class Beat Historical Barriers

Turner’s class marks another step in the CFP Board's slow recognition over the last decade that technology and practice management topics play a more central role in a modern professional practice.

Turner’s class marks another step in the CFP Board's slow recognition over the last decade that technology and practice management topics play a more central role in a modern professional practice.

Traditionally, programs teaching advisors how to use software or build their practice were denied CFP CE approval. The Board reasoned that while important, these topics didn’t enhance a professional’s ability to create a financial plan or give planning advice.

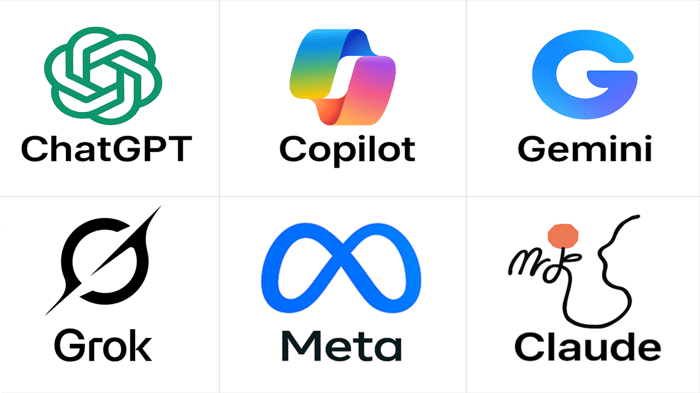

But Turner’s approach is different. His program shows advisors precisely how to use artificial intelligence tools like ChatGPT to improve communications, model planning scenarios in real time, and facilitate deeper client understanding. By linking the use of AI directly to improving the financial planning process, this class met the Board’s standards—and earned CE approval.

What Makes This Class Stand Out As the Best CFP CE in 2025?

This is more than just another technology webinar. Turner’s expertise comes from a unique background as a journalist, novelist, and small business consultant. His perspective emphasizes storytelling and prompt design—skills critical to using generative AI effectively. Advisors learn how to craft prompts that yield meaningful outputs, select the right AI tools, and embed these practices directly into financial planning conversations.

The result? A CE session that is not just about pushing out more emails or automating mundane tasks, but truly about elevating client engagement and the quality of financial planning advice. Incidentally, this class is also eligible for IAR CE, CIMA CE, and CPE for CPAs, allowing professionals with two or three credentials to slash the cost of a class -- as well as how much time they must spend earning CE classes -- by 50% if they have two designations or by 66% if they have three designations.

A Longstanding CFP Board Policy Has Slowly Shifted

It’s worth revisiting how the CFP Board policy has slowly shifted. According to the CFP Board’s CE guidelines, topics like practice management, marketing, public accounting, computer hardware, software training, and general business development are all excluded from qualifying for CE. This is still the case, per their latest CE Sponsor Handbook.

Turner’s class successfully threaded the needle by demonstrating how AI applications directly support financial planning work—helping clients understand choices, navigate complex scenarios, and engage more confidently in their financial decisions.

How CFP Board Compares to NASBA and NASAA Rules

For comparison, consider how other regulatory and credentialing bodies handle CE approval of practice management topics. The National Association of State Boards of Accountancy (NASBA), which administers standards for CPA continuing education across the United States, broadly allows classes that help CPAs improve professional competence. Under the Statement on Standards for Continuing Professional Education (CPE) Programs permit credit for courses on technology, practice management tools, and business processes—as long as they can be shown to contribute to a CPA’s professional skill set.

Likewise, the North American Securities Administrators Association (NASAA) Model Rule on Investment Adviser Representative Continuing Education, adopted in many states, outlines required CE hours split between Products & Practice and Ethics & Professional Responsibility. Under this framework, courses on using AI to evaluate client needs or deliver financial solutions often qualify for credit, especially when tied to how advisors fulfill fiduciary or suitability obligations.

This means that for many professionals who hold multiple credentials—CPAs, CPA/PFSs, and IARs operating under a state that enacted NASAA’s Model CE Rule—classes like Turner’s not only enhance their practice but neatly check off several CE compliance boxes at once. In fact, the broader rules under NASBA and NASAA highlight how relatively conservative the CFP Board’s approach historically has been. Turner’s approval continues a gradual evolution by the CFP Board toward a more holistic view of what CE topics financial professionals truly need.

What Advisors Can Expect From This CE Program

Participants gain hands-on insights into how AI can:

- Enhance the quality of client conversations

- Generate tailored planning content instantly

- Run scenario analyses that clients can follow more easily

- Save hours on administrative research, freeing up time for high-value planning work

This is why it merits being called the best CFP CE in 2025. It blends practical, immediately-actionable technology guidance with ways to include personal financial facts in client communications, craft financial economic scenarios clients can better understand, enabling this class to satisfy CFP Board requirements.

Will the CFP Board Expand CE Eligibility Further?

This approval may be a bellwether. As technology becomes more tightly woven into how advisors deliver financial advice, the rigid lines separating “planning knowledge” from “business technology” are harder to justify. A well-equipped advisor needs both sets of skills to serve clients competently in the modern era.

It remains to be seen whether the CFP Board will formally adjust its CE policies to explicitly include more technology courses. For now, cases like Turner’s class show that with careful framing—tying tech back to the client planning experience—such programs can clear the hurdle.

Why It Matters for Advisors Looking for the Best CFP CE in 2025

If you’re serious about staying ahead in the profession, finding CE that is both compliant and truly useful is key. Turner’s AI class does that, positioning itself squarely among the best CFP CE options in 2025. It reflects a subtle but important evolution in what the Board considers essential to financial planning competency. Which is excellent news for Advisors4Advisors members because we've always walked the fine line between teaching technology while always bringing it back to how to apply it in planning.

Final Thoughts: Watch This Space

As a long-time observer of the CFP Board’s approach to continuing education, I find this decision encouraging. It shows a growing recognition that technology is not just a back-office tool but a frontline asset in delivering better advice. Advisors who embrace these capabilities now will be best positioned to thrive—and classes like Turner’s give them the sanctioned hours to do it.

If you’re an Advisors4Advisors member, check your email for links to attend. If your membership expired or you didn’t receive the invite, you can renew or buy the class individually. Either way, this is one CE session that truly earns its place as the best CFP CE in 2025.

#FinancialPlanning #CFPCredits #BestCFPCE #AIforAdvisors #CraigTurner #ContinuingEducation