If you're searching for the best IAR CE programs or trying to understand how NASAA’s IAR CE requirements impact you, you're in the right place. The North American Securities Administrators Association (NASAA), a 105-year-old regulatory organization, has significantly elevated the professional education standards for Investment Adviser Representatives (IARs). As of January 2025, NASAA’s model IAR CE rule is now in effect in 22 states, including major markets for wealthy financial consumers like California, Colorado, and Florida.

If you're searching for the best IAR CE programs or trying to understand how NASAA’s IAR CE requirements impact you, you're in the right place. The North American Securities Administrators Association (NASAA), a 105-year-old regulatory organization, has significantly elevated the professional education standards for Investment Adviser Representatives (IARs). As of January 2025, NASAA’s model IAR CE rule is now in effect in 22 states, including major markets for wealthy financial consumers like California, Colorado, and Florida.

From the point of view of a pioneer of online CE and CPE since October 2008, NASAA's initiative places the unusual alliance of state regulators at the forefront of financial advisor education and sets new standards that surpass those required by other major designations, including CFP, CIMA, and CPA. Here's what you need to know.

What Is IAR CE, and Why Does It Matter?

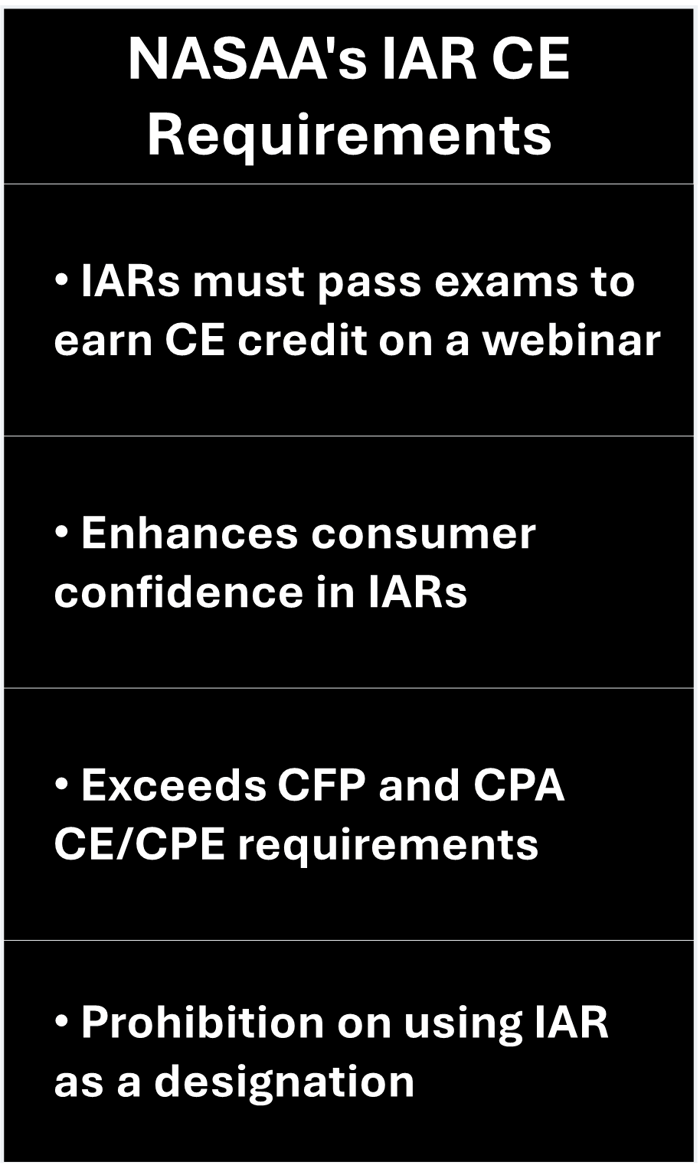

Investment Adviser Representatives (IARs) are now required to earn 12 Continuing Education (CE) credits annually. Unlike traditional CE programs for CFPs and CPAs, NASAA’s IAR CE standards mandate that participants pass a test after each class to demonstrate they’ve met the learning objectives. This rigorous approach ensures IARs genuinely understand the material, not just attend a class for credit.

By comparison:

- CFP professionals earn 1 CE credit for attending a 50-minute webinar—no test required.

- CPAs must answer three polls during a live webinar, but their responses are not scored.

With NASAA’s model, there’s no free pass. To earn IAR CE credits, you must engage with the material and prove your knowledge. This tougher standard is a significant step forward for the financial advice profession. This is coming from a CE/CPE provider since October 2008 and one of the best IAR CE providers in the U.S.

NASAA’s Model Rule: Effective in 22 States

Since NASAA published the Investment Adviser Representative Continuing Education (IAR CE) Model Rule in November 2020, it has been widely adopted across the United States. As of January 2025, 22 states, including Florida, California, and Colorado, require IARs to meet these new CE standards. This includes passing 12 exams each year—one for each credit earned.

Historically, becoming an IAR was one of the easiest paths into financial advising. You could manage up to $100 million in assets with no CE requirements, no CFP or CPA designation, and minimal regulatory oversight. NASAA’s model rule changes that by:

- Establishing annual education requirements.

- Requiring evidence of learning through testing.

- Enhancing consumer confidence in IARs’ professionalism.

Why IAR CE Is a Game-Changer

NASAA’s new rules provide several key benefits:

- Enhanced Consumer Trust: Requiring IARs to complete annual education and pass exams ensures that only serious professionals can maintain their status.

- Higher Standards for the Industry: NASAA’s requirements outpace those for CFP and CPA financial planners, making IAR CE the gold standard in professional education.

- Deterrence for Fraudsters: The mandatory exams and annual CE requirements discourage unqualified or unethical individuals from entering the industry.

For consumers, this means greater confidence in their IAR’s ability to manage their financial future.

How A4A Supports IAR CE Compliance

A4A, among the best IAR CE providers in the U.S., understands that meeting these new requirements can be challenging. That’s why we’ve developed systems to help IARs efficiently satisfy their CE obligations. Our programs are designed to provide:

- Engaging, high-quality content that meets NASAA’s stringent requirements.

- User-friendly platforms for seamless learning and testing.

- Efficient compliance tracking to help you stay ahead.

Publishing the right amount of content for IAR CE is also very important. Providing the best IAR CE is very different from providing the most. IARs do not need to be bombarded with details about every possible tax strategy known to full-time CPAs, JDs, and estate tax specialists.

The best IAR CE course could be designed around the six-hour annual requirement on Practice Topics. The best IAR CE program is mindful that you might want to earn tax CE or CPE from multiple sources and there are so many other topics important topics to learn about.

Moreover, the topics and instructors must teach the latest news. Economic data has a one-month shelf life. So getting a one-hour update monthly is about right. A quarterly update on strategic portfolio design is also a bread and butter necessity. A dose of financial counseling, along with a class or two about insurance annually and updates on specialties, like real estate investing. That what we've been doing for since the week Lehman Bros. fell.

If you’re looking for the best IAR CE provider, A4A is here to support you. This post details why A4A is the best IAR CE provider you can find.

An Ironic Twist

Regulators have always been careful to distinguish IA reps from professional designations, like CFP or CPA. But the relatively new IAR CE Model Rule could blur the line.

To own an RIA or somehow otherwise be an IA Rep requires a few days of study and preparation for a Series 65 or 66 exam. It's not a high bar to enter the field. As a result, it has always been considered misleading to append "IAR" to your name, on your business card, as if it is a professional designation, and it probably remains so. However, now that calling yourself an IAR means you are required to take 12 hours of classes annually, the term carries a bit more weight.

This is not to say that it would be acceptable to federal or state regulators to use "IAR" as a designation appended to your name on a business card or in marketing marketing materials, much less ethical.

Key Takeaways for IARs

- IAR CE Is Now Mandatory in 22 states, with more expected to follow.

- Testing Is Required to earn credits, setting IAR CE apart from other professional education standards.

- NASAA’s model is a win for financial consumers and raises the bar for professionalism in the industry.

- A4A offers streamlined solutions to help IARs meet these new requirements efficiently.

Final Thoughts: Why IAR CE Matters

NASAA’s entry into regulating IAR CE marks a pivotal moment for the financial advice profession. By raising the educational requirements for IARs, NASAA is ensuring that financial consumers receive advice from knowledgeable, committed professionals.

Whether you’re an IAR seeking the best IAR CE program or a consumer looking for a trusted advisor, these new standards benefit everyone.