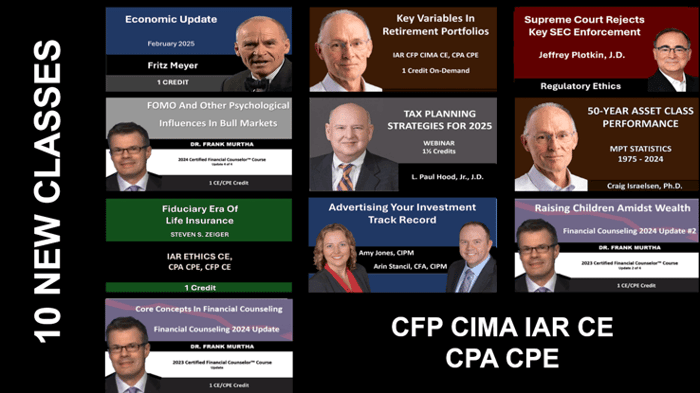

If you’re looking for CFP CE on current economic trends and market strategies, Fritz Meyer’s monthly class is a top resource. As an independent economist, Fritz Meyer monthly CFP CE on current economic trends and market strategies averaged 4.7-star ratings from advisors monthly for over a decade, providing financial professionals with valuable insights and actionable data.

A highly-abbreviated version of what Fritz said at a March 11, 2025 webinar, offering 1 CFP CE credit on current economic trends and market strategies, follows:

Today, we’re providing financial advisors with CFP CE on current economic trends and market strategies, covering market shifts, investment strategies, and economic indicators. These slides can be customized and used in your practice to inform and educate clients.

Economic conditions are evolving rapidly, with the ISM Manufacturing Survey and retail sales reflecting volatility. The S&P 500 has declined by nearly 10%, signaling a market correction and increased uncertainty among investors.

However, current economic trends and market strategies show resilience. The Fed’s preferred inflation gauge, PCE, has cooled to 2.5%, and February’s job growth remains strong. Despite minor downward earnings revisions and fluctuating bond yields, key economic indicators remain stable.

For advisors earning CFP CE on current economic trends and market strategies, it’s critical to analyze the ISM Manufacturing Index, which saw a steep drop in February, particularly in new orders. Retail sales also declined, possibly due to harsh winter conditions. Walmart’s revenue revision further pressures the market outlook.

The Atlanta Fed’s GDP forecast caught analysts off guard with a sharp downward revision, reinforcing concerns about near-term economic growth.

Providing CFP CE on current economic trends and market strategies necessitates a discussion on tariffs. Tariffs have fueled economic uncertainty, potentially increasing consumer prices and restraining economic output. While concerns persist, their true impact may be exaggerated, depending on geopolitical developments.

Media outlets continue to highlight tariffs as controversial, with some branding them ineffective trade policy. In these CFP CE sessions on current economic trends and market strategies, we focus solely on economic impacts rather than political debates.

The ISM Services Index offers a more optimistic perspective, as the service sector accounts for 91% of U.S. non-farm employment. Strong performance in this area indicates overall economic stability and continued labor market strength.

Housing starts dipped after a strong December, yet demand remains high due to a persistent supply shortage. Construction activity remains steady, bolstered by a strong employment sector.

A key focus of CFP CE on current economic trends and market strategies is household finances. Net worth has surged, fueling consumer spending through the wealth effect. While credit card debt is rising, it remains manageable relative to income levels.

Economic forecasts play a crucial role in CFP CE on current economic trends and market strategies. The Conference Board and New York Fed project GDP growth around 2.3%, countering widespread recession concerns. While uncertainty exists, the overall sentiment remains optimistic.

Recent market pullbacks may suggest a correction, which can create strategic buying opportunities for investors.

Historical context is always emphasized in CFP CE on current economic trends and market strategies. Recessions have historically led to market volatility, but accurately predicting them remains challenging.

Stock valuations have moderated following recent corrections. History suggests high valuations can persist for extended periods without triggering economic distress. Even with rising bond yields, P/E ratios remain within historical norms, reinforcing market stability.

Monetary policy remains a central discussion point in CFP CE on current economic trends and market strategies. Interest rates have stabilized following aggressive hikes, and the yield curve is showing signs of normalization, easing recession concerns.

Inflation trends continue to align with historical patterns. CPI and PCE data show inflation is gradually cooling, confirming successful post-pandemic economic stabilization.

Finally, CFP CE on current economic trends and market strategies must address fiscal policy. Expanding deficits and rising national debt remain critical concerns. Although U.S. tax burdens remain relatively low, political obstacles hinder essential fiscal adjustments. Tax increases may become necessary to sustain key government programs in the long run.

Now, let’s address some key questions from this CFP CE on current economic trends and market strategies session.

How can the U.S. encourage other countries to lower tariffs? A strategic, case-by-case approach is often more effective than broad tariff applications.

Labor shortages in sectors like construction and hospitality, partly due to deportation policies, remain an economic concern. These industries rely on undocumented labor, and workforce reductions could impact economic productivity. In CFP CE sessions on current economic trends and market strategies, we focus strictly on economic implications rather than policy debates.

Some have suggested removing government spending from GDP calculations, but doing so would be misleading since government expenditures significantly contribute to economic activity.

A participant in this CFP CE on current economic trends and market strategies session asked about state and local government financial stability. While federal budget cuts could impact some municipalities, most remain financially stable unless heavily reliant on federal grants.

Earnings growth projections remain strong, with inflation expectations factored in. As highlighted in CFP CE sessions on current economic trends and market strategies, analysts frequently update forecasts based on economic events like tariffs and government shutdowns.

A question was raised about discretionary spending reductions. In CFP CE on current economic trends and market strategies, we analyze government data, which shows that discretionary spending represents a small portion of the federal budget, making substantial cuts unlikely.

Tax policy remains a major economic concern. While tax increases can reduce disposable income, U.S. tax burdens remain lower than many other developed nations. A slight increase could enhance long-term fiscal stability.

Tax comparisons between the U.S. and Europe are often debated. In CFP CE on current economic trends and market strategies, we explore how Americans pay lower taxes than their European counterparts but also face higher out-of-pocket costs for education and healthcare. This reality provides a broader perspective on global tax burdens and public services.

Technology and automation trends have also been influencing economic growth, impacting job markets and investment strategies. Future CFP CE sessions on current economic trends and market strategies will continue to explore these evolving dynamics.