Table of Contents

- Real Economic Insight, Not Just The Best CE Explains Is Why A4A Is Quoted by Barron’s

- Real Economic Insight Through Public Dialogue: A4A Responds to BKS

- Why Barron’s Cited Us On Such A Lofty Economic Issue And What It Means for Advisors

- For Real Economic Insight, The Best CFP CE Provider

- Only The Best CFP CE Providers Could Be Cited On Economics By Barron’s

- Try the Best CFP CE Provider with Real Economic Insight Today

- FAQs

Real Economic Insight, Not Just The Best CE Explains Is Why A4A Is Quoted by Barron’s

When Barron’s cited Advisors4Advisors this week in a feature exploring risks to the “Trust America” trade, they weren’t just pulling a quote from a financial blogger. They were amplifying a voice grounded in decades of financial journalism, policy analysis, and a deep respect for the truth behind the numbers and a drive to be among the best CFP CE providers.

“Questions about whether Trump can manipulate jobs data are no longer abstract hypotheticals—they're practical concerns facing economists, journalists, and the public alike,”

— Andrew Gluck, quoted in Barron’s, August 2, 2025

The quote, originally published on our blog, was in a post analyzing the dismissal of Bureau of Labor Statistics Commissioner, Erika McEntarfer, and sharp downward revisions to recent jobs data. The post raised concerns about the politicization of U.S. economic reporting and the potential erosion of trust in official statistics. Barron’s Senior Writer, Martin Baccardax, picked up our perspective because it stands apart from the typical industry chatter.

For the record, Advisors4Advisors is grounded in journalism, delivering Continuing Education that equips fiduciaries to think critically and strategically about what’s happening now — not just passively earn credits. Our commitment to education means uncovering truth and understanding the complexities of financial markets across time and borders in real-time. Which compels us to tell you about an episode on Sunday when Mr. Baccardax contacted us about our post on trust in U.S. economic data.

Real Economic Insight Through Public Dialogue: A4A Responds to BKS

A4A added a new comment system on Sunday to our blog—and honestly, I was hesitant about introducing commenting. I worried it might attract trolls. Sure enough, the very first comment came in—from someone named BKS, and it was uncomfortably sharp:

“This article is pretty one‑sided. You’d expect better from A4A—especially when payroll numbers get revised down constantly.”

I felt BKS’s criticism was undeserved, way too harsh, and unjust. For a second, I considered not publishing it. But given our commitment to transparency, I published the comment, despite troll concerns.

Then, I dove deeper. I prompted ChatGPT to analyze the past 10 years of BLS payroll revisions—month by month, year by year. The results were exactly the opposite from facts stated by BKS! Upward revisions outnumbered downward ones, and average revision size shrank over the last five years!

That exchange remains on public display in the comment thread—highlighting what sets A4A apart: a real-time, rigor‑driven approach that makes A4A the best CFP CE provider with real economic insight.

Comment Exchange Table: A4A vs. BKS (Payroll Data Revisions)

Participant | Timestamp | Comment Summary | A4A Response Summary |

BKS | Aug 2, 2025, 12:24 AM | Argues the post was “pretty one‑sided” and payroll numbers “are revised down constantly.” |

|

A4A | Aug 2, 2025, 1:10 AM | Invited ChatGPT analysis of a decade’s worth of BLS payroll data to check revision trends. | Shared findings: upward revisions outnumbered downward, average revision size decreased. Offered link to full ChatGPT data analysis. |

| 🔗 10‑year BLS payroll revisions analysis by ChatGPT | |||

This episode is more than just a moment in time—it underscores A4A’s methodological integrity, analytical depth, and fearlessness in confronting criticism. We don’t simply report opinions—we validate them. That ethos makes us not only a trusted source for CE credit, but one of the most respected CFP CE providers with real economic insight.

Why Barron’s Cited Us On Such A Lofty Economic Issue And What It Means for Advisors

When Barron’s contacted A4A, they weren’t looking for perfunctory commentary. They already had their quote from the blog post. They wanted to use it because it contextualized job revisions, a firing in the BLS, and the market implications—not in sensational terms, but with precision, skepticism, policy savvy, and a respect for history. That’s why our post on the McEntarfer dismissal and payroll revisions, enriched by this public exchange and why Barron’s prominently quoted us on such a weighty issue.

For Real Economic Insight, The Best CFP CE Provider

Advisors4Advisors was founded on the belief that CE should not be a checkbox. It should inform, challenge, and support the mission of fiduciary professionals. That’s why I bring journalistic rigor and policy fluency into every class we produce — from Fritz Meyer’s monthly economic briefings to Craig Turner’s updates on AI for FAs.

We cover:

- Cross-disciplinary topics like behavioral finance, trust law, and AI in wealth management

- How regulation (like NASAA's IAR CE rules) is reshaping advisory firms

- How CFP Board CE requirements are weak compared to IAR CE requirements

Only The Best CFP CE Providers Could Be Cited On Economics By Barron’s

When Barron’s reached out, it wasn’t because we pay for ads on Google. We purely drive interest to our CE content using organic methods--the power of our words on a pressing investment issue affecting fiduciaries: the integrity of U.S. economic data. Only the best CFP CE providers with real economic insight can do that! And this rigor is applied in keeping advisors informed, prepared, and ahead of policy trends as they happen in real time breaking news.

Covering breaking news for an advisor with a long-term perspective is especially important today. Financial professionals can’t rely on what’s hot today to advise clients. CE that deals with messy truths, controversial shifts in governance, and the potential breakdown of institutional norms are always dealing with complex topics as news events are unfolding and must view what’s happening lately through the lens of history to avoid overweighting recent events. At Advisors4Advisors, we produce CE from the front lines of financial journalism, backed by experience in what advisors need to know and a passion to illuminate truth.

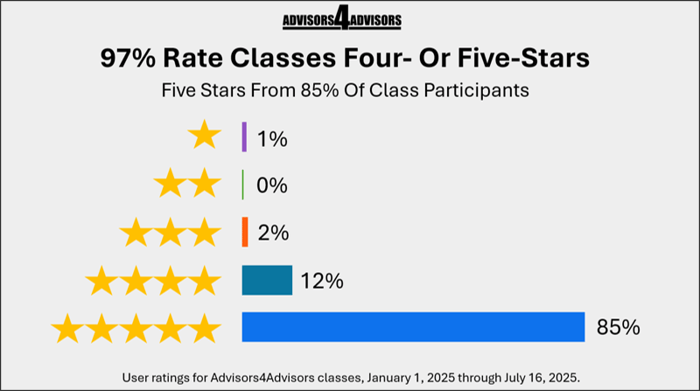

That’s why more advisors are ranking Advisors4Advisors as the best CFP CE provider. Our team of thought leaders, including independent economist Fritz Meyer, portfolio design expert Craig Israelsen, AI for FAs leader Craig Turner, financial counseling advocate Frank Murtha and others reflects the originality of our news coverage.

Try the Best CFP CE Provider with Real Economic Insight Today

If you're tired of CE that wastes your time by insulting your intelligence or that tells you way more technical details you may ever need to know, try A4A amd see why we're the best CFP CE provider for advisors who want more than credit. We’ll continue producing content that earns attention from regulators, researchers — and sometimes, the pages of Barron’s.

FAQs

Why did Barron’s quote Advisors4Advisors?

Barron’s cited A4A because of our blog post analyzing the dismissal of the BLS Commissioner and the risks to trust in U.S. economic data. Our content stood out due to its depth, objectivity, and real-time economic analysis.

What was the comment exchange with BKS about?

A reader named BKS criticized the blog post as “pretty one-sided” and claimed payroll numbers are “revised down constantly.” A4A responded with a detailed ChatGPT analysis of 10 years of BLS data that disproved the claim.

Why was this public exchange so important?

It showcased A4A’s commitment to transparency and truth. Instead of ignoring or deleting the comment, we engaged, researched, and provided factual clarity. This is what makes A4A the best CFP CE provider with real economic insight.

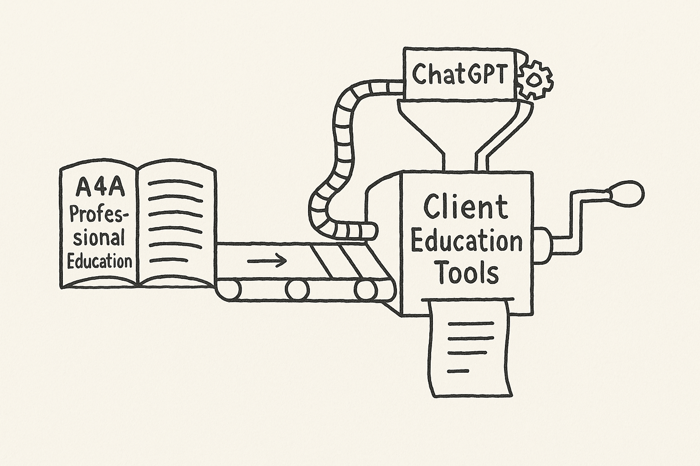

What tools did A4A use to verify the facts?

We used a structured prompt with ChatGPT to analyze 10 years of monthly BLS payroll data. The AI-assisted review showed upward revisions were more frequent, and average revision size had decreased—contradicting the reader’s assertion.

How does A4A differ from other CFP CE providers?

A4A is rooted in journalism and independent economic research. We deliver continuing education that goes beyond checkboxes—covering breaking news, economic data, and policy with the depth fiduciary advisors need to serve clients wisely.

What topics do A4A’s CE courses cover?

Our CE courses span economic trends, AI in wealth management, trust law, behavioral finance, regulation (like NASAA’s IAR CE rules), and more—always explained in real-world terms for busy professionals.

How can I get started with A4A?

Visit advisors4advisors.com to explore our CE courses. Use promo code BARRONS10 for 10% off your first subscription.