Table of Contents

- Understanding the NASAA Model Rule and Why It Matters

- The Regulatory Shift Behind the Best IAR CE Course For Investment Adviser CE Compliance

- Two Categories Define the Best IAR CE Course For Investment Adviser CE Compliance

- Why Ethics Training in the Best IAR CE Course For Investment Adviser CE Compliance Stands Out

- How FinPro Simplifies Compliance and Transparency

- Integrating CE Into Firm Culture

- Building a Sustainable CE Schedule

- Avoiding Common IAR CE Compliance Mistakes

- Why the Best IAR CE Course For Investment Adviser CE Compliance Must Stay Fresh

- Turning CE Into a Competitive Advantage

- How The Best IAR CE Course For Investment Adviser CE Compliance Strengthens Investor Protection

- Technology’s Role in The Best IAR CE Course For Investment Adviser CE Compliance

- A Profession Redefined by The Best IAR CE Course For Investment Adviser CE Compliance

- FAQs

An historic shift in financial advisor regulation is under way. It's brought a new level of consumer protection to nearly half the nation's financial consumers in 23 states. At a time of fierce opposition to federal government regulation, state regulation of Investment Adviser Representative Continuing Education (IARCE) has expanded dramatically. Though the financial press seems oblivious to the seismic regulatory change unfolding over the past several years, it's explored in depth in my aptly titled, "Best IAR CE Course For Investment Adviser CE Compliance."

What makes the enormous regulatory shift especially impactful is not only the number of states that have adopted NASAA's CE framework, but the significant investor protection it has put in place in 23 states. In addition, NASAA has accomplished something the CFP Board, IWI, AICPA, NASBA, CFA Institute and other successful professional bodies were unable to do for decades: create a profession.

Until 2022, mandatory continuing education for IA Reps simply did not exist. There were respected professional credentials that mandated ongoing education, like the CPA, CPA/PFS, CFP, and CIMA certifications, but a state-registered investment adviser could go for decades with no requirement to update their skills, review ethics rules, or even learn about new regulations. In January 2022, that all began to change. That's when NASAA's Model Continuing Education Rule became effective in Maryland, Vermont, and Mississippi.

24 Jurisdictions Have Adopted NASAA’s IAR Model CC Rule

Arkansas (2023) | California (2024) | Colorado (2024) |

Florida (2024) | Hawaii (2024) | Illinois (effective 1/1/2026) |

Kentucky (2023) | Maryland (2022) | Michigan (2023) |

Minnesota (2025) | Mississippi (2022) | Nebraska (2025) |

Nevada (2024) | New Jersey (2025) | North Dakota (2024) |

Oklahoma (2023) | Oregon (2023) | Rhode Island (2025) |

South Carolina (2023) | Tennessee (2024) | Vermont (2022) |

Washington, D.C. (2023) | Wisconsin (2023) | U.S. Virgin Islands (2025) |

From that three-state beginning, the rule spread rapidly. By 2025, 23 states had adopted NASA's model rule. Publicly available data on IAR registrants from the states operating under the model rule show more than 200,000 advisers were subject to the rule in 2025. That's half the IA reps in the nation! Put another way: NASA's model rule now protects nearly half of the American population!

The surprising impact of the IAR CE Model Rule on CFP, CPA, CIMA and other financial advice professionals is explored. For instance, NASAA's IAR CE requirements imposes a 600% increase in ethics education on CFPs and a 300% ethics CPE increase on CPA financial advisors. Designed for professionals seeking CFP and CPA-level rigor, this is 51 minutes of practical takeaways that can be applied immediately.

For investment adviser representatives (IARs), understanding and complying with the NASAA Model Rule for Continuing Education (CE) is not just about checking a compliance box—it’s about elevating professionalism, improving firm culture, and reinforcing public trust. The Best IAR CE Course For Investment Adviser CE Compliance provides clear, practical guidance on how the rule works, why it matters, and how to use tools like FinPro effectively to simplify compliance while strengthening fiduciary practices.

Understanding the NASAA Model Rule and Why It Matters

The Best IAR CE Course For Investment Adviser CE Compliance begins with an explanation of the North American Securities Administrators Association (NASAA) and its Model Rule. Adopted by over twenty states since 2022, NASAA’s rule established mandatory CE for IARs—something that didn’t exist before. This rule aligns IARs with the professional standards already required of CPAs, CFPs, and CIMAs, closing a decades-old gap in investor protection.

The Regulatory Shift Behind the Best IAR CE Course For Investment Adviser CE Compliance

Until 2022, an adviser could pass the Series 65 exam and never again be required to update their knowledge. The Model Rule changed that, making annual continuing education mandatory for more than 200,000 advisers across the U.S. This sweeping regulatory shift has gone largely unreported by mainstream media, yet it represents one of the most significant advances in investor protection in decades.

Two Categories Define the Best IAR CE Course For Investment Adviser CE Compliance

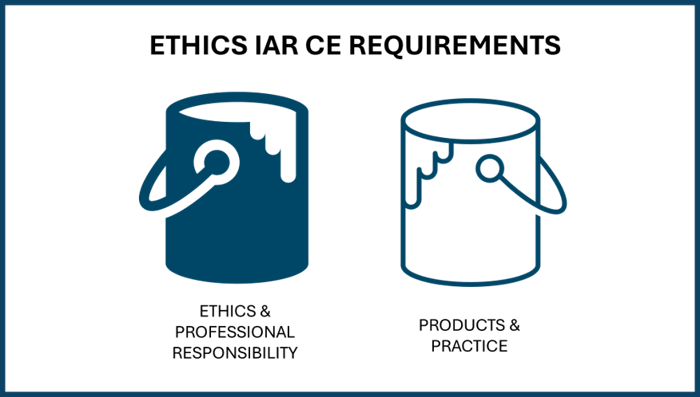

NASAA divides CE into two categories: six hours in Ethics and Professional Responsibility, and six hours in Products and Practice. The ethics portion emphasizes fiduciary judgment, conflicts, and supervision, while the technical portion covers topics like risk management, planning, and cybersecurity. Together, these categories ensure advisers maintain both moral and technical competence.

Why Ethics Training in the Best IAR CE Course For Investment Adviser CE Compliance Stands Out

NASAA requires six hours of ethics and professional responsibility CE annually—six times more than CFP Board’s requirement and triple that of most CPA boards. This massive increase underscores the seriousness of fiduciary accountability. The Best IAR CE Course For Investment Adviser CE Compliance turns this requirement into a meaningful exercise that strengthens advisers’ ethical decision-making.

How FinPro Simplifies Compliance and Transparency

The FinPro system, maintained by FINRA in partnership with NASAA, allows IARs to track and verify CE credits automatically. Providers—not advisers—are responsible for recordkeeping, and credits post directly to each IAR’s transcript tied to their CRD number. This transparency eliminates the paper-certificate chaos and provides a verifiable, regulator-accessible record of professional diligence.

Integrating CE Into Firm Culture

The Best IAR CE Course For Investment Adviser CE Compliance emphasizes that compliance can also improve firm culture. Encouraging advisers to share takeaways from each class at staff meetings builds collaboration and accountability. Regular CE discussions often lead to tangible improvements—like reviewing ADV language or tightening cybersecurity policies—making education part of the firm’s DNA.

Building a Sustainable CE Schedule

One of the most practical lessons from the Best IAR CE Course For Investment Adviser CE Compliance is to treat CE as a quarterly routine rather than a year-end scramble. Advisers can divide their 12-hour requirement into quarterly segments: one ethics class and one products-and-practice session per quarter. This approach helps maintain consistency, prevents compliance lapses, and reinforces continuous learning.

Avoiding Common IAR CE Compliance Mistakes

Advisers often make preventable errors, such as mistaking professional-responsibility classes for ethics, entering incorrect CRD numbers, or assuming cross-credit between designations. The Best IAR CE Course For Investment Adviser CE Compliance addresses these pitfalls and teaches participants how to verify approvals and upload data correctly to FinPro.

Why the Best IAR CE Course For Investment Adviser CE Compliance Must Stay Fresh

The financial world changes fast—AI, cybersecurity, ESG, and digital assets reshape the landscape every year. That’s why the Best IAR CE Course For Investment Adviser CE Compliance must be continually updated. Providers that refresh course catalogs monthly or quarterly, rather than once a year, give advisers the insight needed to stay truly current and compliant.

Turning CE Into a Competitive Advantage

Twelve hours of CE a year may sound small, but it’s transformative when applied intentionally. Each credit represents renewed mastery of fiduciary ethics and technical skill. By promoting CE achievements and sharing FinPro transcripts with clients, advisers demonstrate credibility and differentiate themselves in a crowded market. In that sense, the Best IAR CE Course For Investment Adviser CE Compliance isn’t just about meeting a rule—it’s about becoming a better professional every year.

How The Best IAR CE Course For Investment Adviser CE Compliance Strengthens Investor Protection

The NASAA Model Rule represents a structural evolution in investor protection. By enforcing continuing education for all IARs, the rule helps ensure that those managing client assets remain competent in both ethics and products. The Best IAR CE Course For Investment Adviser CE Compliance reinforces this principle by showing advisers how ongoing education protects not only their clients but also their professional reputations. As markets evolve—with complex investment products, AI-driven strategies, and rapid regulatory updates—the course teaches advisers how to stay compliant and credible in a changing environment. This proactive approach reduces regulatory risk and demonstrates a commitment to maintaining the highest fiduciary standards.

Technology’s Role in The Best IAR CE Course For Investment Adviser CE Compliance

Technology is central to the new CE era. Systems like FinPro and IARD automate tracking, reduce errors, and make CE completion transparent. The Best IAR CE Course For Investment Adviser CE Compliance highlights how to leverage these systems effectively, turning what was once a confusing process into a seamless experience. Automation also ensures portability—your CE record follows you if you switch firms or states, preserving continuity and credibility. The course encourages advisers to review their FinPro transcript quarterly, creating habits that prevent compliance surprises and strengthen operational discipline across teams.

A Profession Redefined by The Best IAR CE Course For Investment Adviser CE Compliance

Perhaps the most powerful outcome of the Best IAR CE Course For Investment Adviser CE Compliance is how it redefines what it means to be a professional financial adviser. Before the Model Rule, IARs were not required to pursue any continuing education, creating a gap in consumer trust. Now, CE is a hallmark of credibility—aligning advisers more closely with doctors, accountants, and attorneys who all maintain rigorous ongoing education standards. Each credit completed represents a reaffirmation of fiduciary responsibility and mastery of evolving investment knowledge. In this way, CE compliance is no longer just about avoiding penalties—it’s about participating in a new era of professionalism that elevates the entire industry.

NASAA's 2025 IAR CE Deadlines

FAQs

What is the NASAA Model Rule for Investment Adviser Representative Continuing Education (IAR CE)?

The NASAA Model Rule requires all state-registered investment adviser representatives to complete 12 hours of continuing education each year—six hours in Ethics and Professional Responsibility and six hours in Products and Practice. The goal is to ensure advisers maintain technical competence and ethical judgment throughout their careers.

How many states have adopted the IAR CE Model Rule?

As of 2025, 23 states and jurisdictions have adopted NASAA’s IAR CE Model Rule. This expansion began in 2022 with Maryland, Vermont, and Mississippi, and now covers nearly half the nation’s IAR population—representing more than 200,000 advisers.

Why is this regulatory change so important?

For decades, state-registered advisers faced no mandatory continuing education. The adoption of NASAA’s Model Rule fills a long-standing gap in investor protection and elevates financial advice to the same professional standard expected of CPAs, CFPs, and CIMAs. It effectively transforms investment advice into a regulated profession grounded in ongoing education.

What makes this course the Best IAR CE Course For Investment Adviser CE Compliance?

This course provides clear, practical guidance on complying with the Model Rule while offering insight into how CE enhances firm culture, compliance, and fiduciary standards. It also shows advisers how to use FinPro effectively to verify and track CE completions seamlessly.

How is the IAR CE rule different from CE requirements for CFPs or CPAs?

NASAA’s Model Rule is significantly more rigorous in ethics. IARs must complete six hours of ethics and professional responsibility each year—six times the annual ethics requirement for CFPs and three times the requirement for CPAs. This underscores a stronger regulatory emphasis on fiduciary accountability.

How does FinPro simplify compliance for IARs? F

FinPro, maintained by FINRA in partnership with NASAA, is the secure online system where CE completions are tracked. Providers—not advisers—upload CE data directly to FinPro, eliminating paperwork and reducing errors. Advisers can log in anytime to review their transcript, ensuring full transparency and easy recordkeeping.

What happens if I fail to complete the required 12 hours of CE?

Failure to complete IAR CE requirements can result in a lapse of registration eligibility. Advisers who fall behind cannot renew their registration until their CE is complete and reported through FinPro. Maintaining a quarterly CE schedule helps avoid last-minute issues and regulatory delays.

Why must the Best IAR CE Course For Investment Adviser CE Compliance stay current?

Financial regulation, technology, and product innovation evolve rapidly. AI, ESG, digital assets, and cybersecurity reshape adviser responsibilities every year. The best IAR CE programs are not static—they’re updated monthly or quarterly to reflect emerging issues so advisers stay current with real-world developments.

Can CE help my firm beyond compliance?

Yes. CE is a powerful cultural tool. Firms that integrate CE into staff meetings, discuss takeaways, and share insights across teams strengthen compliance awareness and client trust. This course encourages advisers to turn education into collaboration—transforming mandatory training into a strategic advantage.

How can I use my IAR CE to build credibility with clients?

Advisers can use FinPro transcripts to demonstrate professionalism and transparency. Sharing CE progress in newsletters or client updates helps clients see that education is ongoing—not just a licensing requirement. It reinforces the adviser’s fiduciary commitment and differentiates their practice from competitors