For investment advisers representatives (IARs), understanding withdrawal rates is one of the most important topics of advice. This post showcases Advisors4Advisors ability to provide high-quality IAR CE (Continuing Education) content by dissecting nuances of withdrawal rates and their impact on retirement portfolios. In about 1000 words, key points key points from a new class by Craig Israelsen, Ph.D., an instructor on Advisors4Advisors since 2009, are summarized, exploring pivotal concepts to practicing prudently, professionally and successfully.

The Complexity of Withdrawal Rates

Withdrawal rates are a fundamental part of retirement planning. The classic advice many have heard involves the "4% rule." This rule suggests withdrawing 4% of your retirement savings annually. While it is a popular guideline, Dr. Israelsen's 1-credit CFP CIMA and IAR CE, and CPA CPE, class teaches advisors about the more intricate reality.

The longevity of a retirement portfolio is primarily influenced by its withdrawal rate. Prof. Israelsen's findings contradict a widely-held belief that, once withdrawal begins, the only direction of the portfolio's value is downward. This is not necessarily true. By assuming a reasonable withdrawal alongside portfolio growth, retirees may find their average withdrawal rate to be significantly greater than anticipated. This is just one bit of the knowledge qualifying this as high-quality IAR CE.

Analyzing a $500,000 Portfolio Over 25 Years

Dr. Israelsen's analysis methodically approaches the complexity of the withdrawal rate riddle. He examines at a hypothetical $500,000 portfolio and attempts to establish a maximum annual withdrawal rate that allows for a 50% reduction in portfolio value over a 25-year span. This assumes a steady withdrawal rate each year, which still leaves a substantial portion of the portfolio intact after 25 years.

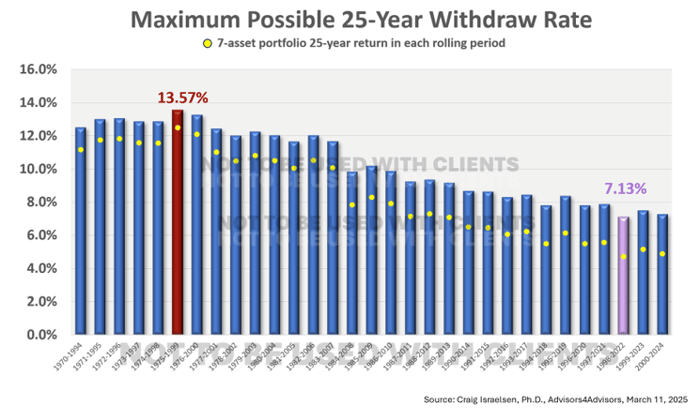

A unique aspect of this analysis is that it incorporates historical data, evaluating 31 rolling 25-year periods between 1970 and 2024. The goal? Understanding how different market conditions influence withdrawal rates and the overall sustainability of a retirement portfolio. Prof. Israelsen uncovers a key finding: consistent 25-year periods that supported withdrawal rates above 4%. Adding to the conventional wisdom of the 4% withdrawal rate, this high-quality IAR CE class is illustrated below.

Portfolio Diversification and Historical Insights

The analysis utilizes a seven-asset class model: large-cap U.S. equity, small-cap U.S. equity, non-U.S. equity, real estate, commodities/clean energy, U.S. bonds, and U.S. cash. Each asset class plays a role in balancing risk and return in the portfolio.

Historical data shows that returning to rigid withdrawal strategies could leave retirees at a disadvantage. In certain scenarios examined, a strategy yielding a 12.5% withdrawal rate over 1970 to 1994 still left half the initial portfolio at the end of 25 years. However, events like the financial crisis in 2008 starkly demonstrate how volatility impacts withdrawal rate dynamics. The withdrawal rates dropped from above 12% to below 10%. Underscoring the need for adaptability in withdrawal strategies helps make this class high-quality IAR CE.

Optimal Withdrawal Rates from Historical Data

The presentation by Dr. Israelsen methodically outlines varied 25-year withdrawal rates, illustrating that a more aggressive rate than the traditional 4% could still preserve much of the portfolio. However, a pivotal takeaway is the importance of maintaining a balanced perspective: the 4% rule serves as a conservative starting point, not an absolute guideline.

Sequence of Returns Risk

One of the critical concepts related to withdrawals is the Sequence of Returns Risk—the risk of experiencing poor investment returns at the beginning of the retirement period. If the market dips early in retirement, withdrawal strategies must adapt to preserve the portfolio's longevity. Understanding this risk, alongside knowing when and how much to withdraw, requires a nuanced approach that may potentially diverge from conventional wisdom. It's a knowledge point practitioners can only find in high-quality IAR CE programs.

Rethinking Fixed Withdrawals: The Scenario Analysis

Craig Israelsen's detailed scenarios in this high-quality IAR CE class offers an invaluable perspective:

- A hypothetical 10.3% average sustainable withdrawal rate** across historical periods indicates that withdrawal rates could significantly exceed 4% while still leaving the portfolio viable.

- Adapting a percentage-based withdrawal has its advantages—flexibility in reducing or increasing withdrawals based on the actual portfolio performance.

What emerges is a clear narrative: the decision of whether to maintain fixed withdrawals or adaptive ones should not be standardized. Each retiree's situation is unique, and so should be their strategy.

A High-Quality IAR CE Learning Experience

The class is organized into five sections:

- Instructions

- 52-minute video presentation by Dr. Murtha

- Engagement Exercise

- Scored assessment

- Satisfaction survey

Left-side navigation bar guides you through completing all five sections of the class. by IA reps must score 70% or higher to earn a class completion certificate.

No-Fail Guarantee

Advisors4Advisors offers a no-fail guarantee:

Assessment questions are designed to be easy to answer if you pay attention.

Learning objectives advertised before the class spell out assessment questions.

A money-back guarantee ensures risk-free participation.

Practical Implications and Final Thoughts

Developing a prudent retirement withdrawal strategy is crucial for investment advisors and finance professionals. It requires staying informed, historical insight, and applying practical strategies that are adaptable to each client's specific situation. The high quality IAR CE provided by Advisors4Advisors is why we have been around since 2009, providing CFP CE and CPA CPE approved for credit for financial professionals including CIMA, CPA/PFS, ChFC, and others.

For those seeking to earn IAR CE credits, this content provides an in-depth view into the dynamic nature of portfolio withdrawals. With research-backed evidence from Israelsen and a thorough understanding of withdrawal dynamics, you are better equipped to guide your clients toward a financially secure retirement.

In conclusion, high-quality IAR CE empowers advisors with knowledge and tools to help their clients navigate the nuanced landscape of retirement withdrawals. By embracing a more comprehensive understanding of retirement portfolio withdrawal rates, advisors can significantly enhance the value they offer clients, establishing a foundation of trust and security evidence-based, data-driven retirement planning.

Remember, the key to a sustainable retirement strategy is flexibility and understanding market tendencies and behaviors over time. By seeking out high-quality IAR CE classes, you are on a path to an informed approach in your mission to help clients achieve their financial and life goals.