Quality IAR CE Built on Historical Perspective and Practical Wisdom

In uncertain times, financial professionals must be equipped not just with knowledge—but with wisdom. That’s the driving force behind “Five Slides to Show Retirees,” a Quality IAR CE course led by Dr. Craig Israelsen. Based on nearly a century of market data, this CE course offers investment adviser representatives (IARs) actionable insights to calm client anxiety and reinforce time-tested investing principles.

Whether you're a CFP, CPA, CIMA, or IAR, this course is a goldmine of practical tools. It not only fulfills CE requirements but enhances the way you communicate risk, resilience, and retirement sustainability to clients.

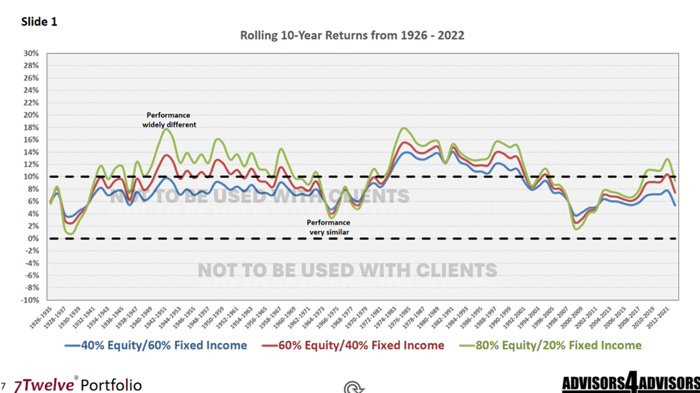

A Century of 10-Year Returns — No Negative Decades

A Century of 10-Year Returns — No Negative Decades

Dr. Israelsen starts with a powerful graph: 10-year rolling returns of three portfolio types (40/60, 60/40, and 80/20 equity/fixed income) spanning nearly 100 years. The big takeaway?

There has never been a 10-year period where any of these portfolios produced a negative return.

That’s right. Even during the Great Depression, the dot-com bust, and the 2008 crisis, a client who stayed the course for a decade didn’t lose money in any of these allocations. The curves may differ in amplitude, but the return patterns all follow the same general shape.

Why It Matters

This slide illustrates that we are delivering Quality IAR CE. It’s not just about showing returns—it’s about helping clients understand that persistence and emotional durability are their most important “asset class.” Markets can’t supply courage; that has to come from the investor.

Can a Retirement Portfolio Outlast the Investor?

The fear of running out of money in retirement is real. Dr. Israelsen tackles this head-on with rolling 25-year periods (1926–2022), tracking the longevity of retirement portfolios using three strategies:

- Required Minimum Distributions (RMDs)

- 4% Annual Withdrawals

- 5% Annual Withdrawals

Key Findings:

- A 60/40 portfolio never ran out of money over 25 years when using a 4% withdrawal rate.

- 100% of the time, it ended with a balance larger than the starting amount.

- Even with 5% withdrawals, 60/40 portfolio succeeded 97% of the time.

This is historical context at its finest—exactly the kind of evidence-based analysis that distinguishes Quality IAR CE from generic CE content.

Risk of Total Depletion? Not So Fast

Dr. Israelsen flips the fear-based narrative. he shows that in all cases—whether using RMDs, 4%, or 5% withdrawals—none of the portfolio models depleted to zero. That’s with 125 basis points in total expenses factored in.

Conclusion: “Percentage-based withdrawals just don’t liquidate a portfolio,” Israelsen notes. What depletes a portfolio? Panic. Mismanagement. Chasing performance or abandoning a long-term plan. This lesson alone is worth the CE credit.

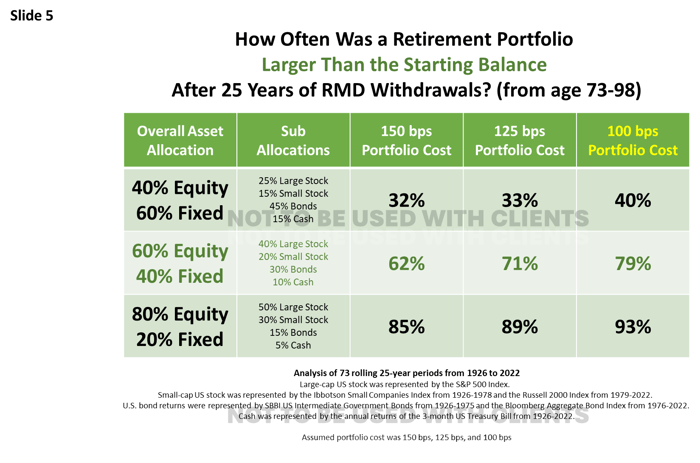

The Cost of Complexity — Why Fees Matter

Here, the course demonstrates how fees and fund costs impact outcomes. With the same RMD-based withdrawal strategy:

- A 60/40 portfolio with 150 bps in total costs was successful 62% of the time.

- That success rate jumped to 79% when fees dropped to 100 bps.

Application for IARs

Clients may be comparing your fees to others. This slide gives you a way to quantify your value: A lower-cost, well-designed portfolio has a significantly higher likelihood of lasting through retirement. This is the kind of granular, client-facing insight that elevates a Quality IAR CE course above checkbox compliance.

How Realistic Is the Future?

How Realistic Is the Future?

The final slide addresses the skeptic’s question: “What if the future doesn’t look like the past?”

Using Israelsen’s spreadsheet tool, advisors can adjust asset class returns downward (e.g., reducing equity returns by 150 bps and real estate by 300 bps) to model pessimistic outcomes.

Even in these conservative scenarios:

- A diversified portfolio still survived 25 years of withdrawals.

- Most ending balances remained well above the initial investment.

It’s not blind optimism—it’s historically grounded realism.

This tool allows IARs to respond credibly to client doubts by showing how a portfolio might perform under stress—not hypothetically, but using altered historical data.

Real-World Applications for IARs

This course doesn’t just provide CE—it arms you with visuals and language that resonate with clients:

- “Markets reward courage.”

- “Ten years is the minimum holding period for success.”

- “Persistence beats timing.”

Whether you're advising retirees or pre-retirees, these narratives are rooted in truth and backed by data. That’s why this offering represents Quality IAR CE at its best.

Why This Course Qualifies as Quality IAR CE

Let’s break down the specific reasons:

✔ Evidence-Based

Every insight is drawn from 100 years of real market data—not assumptions or models.

✔ Client-Focused

The course teaches IARs how to communicate concepts, not just understand them.

✔ Scenario-Driven

Side-by-side comparisons, pessimistic modeling, and adjusted returns help you prepare clients for any market climate.

✔ Practical

By demonstrating how cost, allocation, and behavior affect outcomes, it equips you to offer more value as an advisor.

Bottom Line: CE That Works for You and Your Clients

There’s CE that satisfies requirements—and there’s Quality IAR CE that changes how you engage with clients. Dr. Craig Israelsen’s course falls into the latter category. It’s deeply informative, disarmingly simple, and extraordinarily useful.

When clients say, “This time is different,” you’ll have an evidence-based response. When they ask, “Will I run out of money?” you’ll have a century of data to reassure them. And when they wonder about your fees, you can show them how lower costs increase the chances of portfolio longevity.

Want to Learn More?

This course is available as part of our Quality IAR CE program lineup—built specifically for Investment Adviser Representatives who want more than surface-level education.

✅ NASAA and state-compliant

✅ Designed for practical application

✅ Includes downloadable spreadsheet tools

✅ Approved for CE credit by CFP, CIMA, and IAR programs

Ready to Strengthen Your Value as an Advisor?

Register for “Five Slides to Show Retirees” and other Quality IAR CE offerings today. Help clients stay calm, stay invested, and stay on course.

Craig L. Israelsen, Ph.D., has been a regular contributor to Advisors4Advisors since April 2009. Prof. Israelsen has taught about family financial management at universities and is currently Executive-in-Residence in the Financial Planning Program at Utah Valley University. He teaches classes toward earning a CFA charter. He's a regular contributor to AAII Journal. Craig provides a system to manage low-expense portfolios and educate clients on A4A.