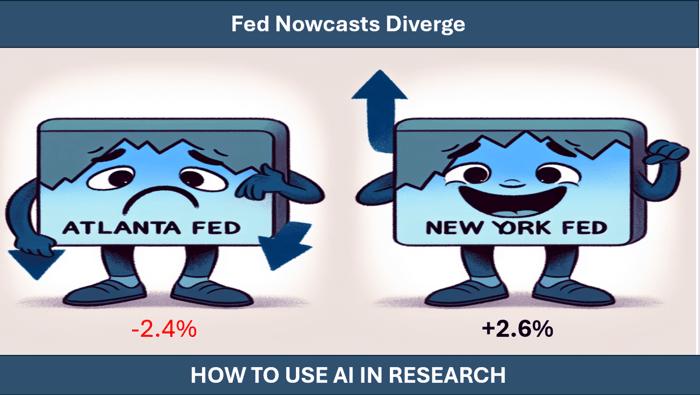

Predicting GDP growth over the next 120 days is important to financial planners and their clients for obvious reasons. Two excellent reports for near-term GDP forecasts are the Federal Reserve Bank of New York's Nowcast and the Federal Reserve Bank of Atlanta's GDPNow. This is the kind of topic that makes this week's list of the best IAR CE classes.

Nowcasts are algorithmic models created by the staff at the Fed branches. They are updated as new data about economic fundamentals are published monthly. So the two nowcasts are usually different from each other but not totally divergent like they are now.

The New York Federal Reserve Bank Nowcast is predicting the economy will grow in the next 120 days by +2.6%, while the Atlanta Fed’s model predicts over the same period the economy will shrink by -2.4%. What’s causing the divergence? Answering that question illustrates a characteristic of the best IAR CE classes.

The New York Fed's Nowcast and Atlanta's GDPNow are two prominent tools used to forecast GDP growth in real-time. Despite relying on the same underlying economic data, they often produce notably different predictions. Why?

For the answer, I turned to ChatGPT’s Deep Research model, which is accessed by clicking a button when submitting a prompt.

ChatGPT Deep Research is a new feature from OpenAI that allows users to conduct in-depth research using an AI-powered agent. “Unlike the standard ChatGPT, which provides quick answers,” according to Google Gemini, Deep Research autonomously browses the web, gathers information from multiple sources, and synthesizes it into a comprehensive, well-cited report.” Generating the findings summarized in this article took about 15 minutes. But it was worth waiting for.

The answer is important to advisors who follow what is widely regarded as one of the best IAR CE classes about investment economics: Fritz Meyer’s monthly webinars.

An independent economist, Fritz Meyer has referenced the Atlanta Fed GDPNow forecasts since around the time it debuted in 2014. The NY Fed Nowcast was launched in 2016 and Fritz began covering that predictive tool in his monthly CE/CPE class in 2022.

With only about half of advisors thought to use AI in their practice, this story made this week's list of the best IAR CE topics, because it not only provides the answer to a question about the two nowcasts but you may also find it instructive read the prompts shown on the right, which were fed into ChatGPT.

The accompanying sidebar shows the precise prompt I wrote to ChatGPT and the source documents. The initial response explaining the divergence was 9,000 words and below it’s been reduced in size to about 1400 words.

The main reason for the divergence in the two nowcasts is because their methodologies—how they process data and translate it into forecasts—are fundamentally differents.

Modeling: Top-Down vs. Bottom-Up

The NY Fed Nowcast is based on a dynamic factor model. It processes dozens of economic indicators to identify a few hidden forces (latent factors) that drive most of the movements across the economy.

GDP growth is inferred from these shared trends. This "top-down" approach assumes that, if you can estimate the overall state of the economy, you can predict GDP.. In contrast, the Atlanta Fed's GDPNow uses a bridge equation model, a "bottom-up" method.

Fritz Meyer, an economist, who teaches monthly on Advisors4Advisors, has referenced Fed branch nowcasts almost since they debuted in 2014. To fulfill our mission of providing the best IAR CE, we wanted to find out why the two forecasts diverge.

After uploading the formulas for the two nowcasts nowcast algorithms, ChatGPT gave me a detailed answer.

My initial prompt asked for “The cause of divergence in predictions in the current NY Fed Nowcast and the Atlanta Fed GDPNow.”

ChatGPT shot back with a question for me: “Could you please clarify what specific time period or forecast release date you are referring to? Also, are you interested in understanding the methodological differences between the NY Fed Nowcast and the Atlanta Fed GDPNow, or the specific causes of divergence in a recent prediction update?”

"I want to know the methodological differences between the NY Fed Nowcast and the Atlanta Fed GDPNow," i replied. "They both use the same data set about GDP. But their algorithms are different in what ways that cause the big disparity in the future of GDP growth just 120 days out? Their algorithmic foundations are described in detail in the attached documents. I want to understand the methodological differences between the NY Fed Nowcast and the Atlanta Fed GDPNow. They both are predicting the same thing: the GDP growth 120 days ahead. Why are they making such different predictions, given that they are predicting the near-term future using the same data set? Based on the attached documents, please explain in layman's terms the elements of their algorithm that are so different. Place the answer in a Word document and make the word count at least 2000 words?

Here are the three documents ChatGPT analyzed:

1. Reintroducing the New York Fed Staff Nowcast

2. The New York Fed Staff Nowcast 2.0

3. GDPNow : A Model for GDP "Nowcasting", Working Paper 2014-7

GDPNow forecasts each of GDP's 13 expenditure components separately—like consumer spending, business investment, government spending, net exports—by linking them to monthly indicators (e.g., retail sales, housing starts). It then sums these up using the same chain-weighting formula as the Bureau of Economic Analysis (BEA).

This bottom-up structure provides more granularity. For example, users can see exactly how much of the GDP forecast comes from each component. This makes GDPNow highly transparent. If the model shows a large forecast, users can pinpoint whether it's driven by, say, strong consumption, rising inventories, or a decline in imports. This modularity is particularly useful for analysts who want to isolate where the economy's momentum is coming from.

Structure and Mechanics

Nowcast Structure: The NY Fed's model estimates five or six latent factors, including one that represents long-term GDP growth. Each incoming data series contributes to estimating these factors. The model is built using a Bayesian state-space framework, allowing it to handle mixed-frequency data and account for missing values. A key feature is its ability to output a full distribution for GDP growth, including confidence intervals.

GDPNow Structure: GDPNow starts with a Bayesian vector autoregression (BVAR) to forecast all 13 GDP components. Then, as new monthly data becomes available, it refines each forecast using bridge equations. For example, retail sales data will update the consumption forecast, while housing starts will influence residential investment. It combines these forecasts using the BEA’s chain-weighting method. GDPNow also has custom procedures for hard-to-predict areas like inventories and net exports.

To maintain our reputation among the best IAR CE class providers, Fritz Meyer will be answering questions about the divergence of the two Fed nowcasts at his next class.

Data Updates and Frequency

The NY Fed Nowcast is updated weekly, and the model evaluates the surprise in each data release and its impact on GDP via changes to the latent factors. This "news decomposition" approach shows which categories (e.g., labor, manufacturing) are responsible for forecast revisions.

GDPNow Updates , in contrast, are triggered by data releases, often multiple times per week. Each new data point directly adjusts the corresponding GDP component forecast. For example, if new trade data arrives, the net exports forecast is updated immediately.

While the Nowcast spreads the impact of any single data point through latent factors, GDPNow responds in a more direct and often more volatile way.

Handling Shocks and Uncertainty

Nowcast: The model explicitly quantifies uncertainty with probability intervals. Recent updates introduced stochastic volatility and a dedicated COVID-19 factor, helping the model adapt to unusual periods. These tools allow the model to dampen the influence of extreme data, treating them as outliers or temporary volatility spikes.

GDPNow: This model provides point estimates without formal confidence intervals, according to ChatGPTs analysis. GDPNow doesn’t dampen extreme values. Instead, it lets actual data speak for itself—big changes in data produce big forecast changes. This made it particularly useful during COVID-19 when traditional models struggled.

GDPNow implicitly handles uncertainty through its modular structure and composition. If inventories swing wildly, GDPNow will show that clearly, while Nowcast might smooth it out. Conversely, the Nowcast is more robust when many indicators move together, identifying shifts in trends more effectively. This is the kind of important detail that’s allowed Advisors4Advisors to be counted among the best IAR CE class providers of 2025.

Why Forecasts Diverge

Even using the same data, forecasts differ due to:

1. Different model logic: The Nowcast infers GDP from broad trends, while GDPNow calculates it from the ground up. This can result in different sensitivities to individual data points.

2. Smoothing vs. direct reaction: A single strong data release (e.g., retail sales) may cause a sharp move in GDPNow, while Nowcast may wait for confirmation from other related data before responding significantly.

3. Coverage differences: GDPNow may use very specific monthly data (like mobile home shipments), which the Nowcast doesn’t explicitly include.

4. Timing of updates: GDPNow may be updated midweek after a big data release; the Nowcast waits until Friday, potentially showing divergence until it catches up.

5. Forecasting missing data: When data is missing, the Nowcast fills it in via historical co-movement of variables. GDPNow projects it using time-series models. These different methods can produce different mid-quarter assumptions.

6. Handling of outliers: GDPNow reflects extreme data directly; the Nowcast may treat it as an outlier unless supported by other series.

7. Model re-estimation: The Nowcast is re-estimated quarterly, potentially adapting faster to structural changes. GDPNow's bridge equations may lag unless manually updated.

Which Is More Accurate?

Accuracy can vary. Evaluations have found both models to be competitive with private forecasts. The Nowcast excels in stability and probabilistic interpretation, especially when many series co-move. GDPNow shines in responsiveness and transparency, clearly showing how each GDP component is performing.

Each model has shown strengths in different environments. During volatile periods like the COVID pandemic, GDPNow's direct-data approach captured swings quickly. In calmer periods, the Nowcast's integration of broad patterns may yield more stable and interpretable signals.

Final Thoughts

The NY Fed Nowcast and Atlanta Fed GDPNow offer different windows into the same economy. One uses latent patterns; the other builds a detailed mosaic. Neither is inherently better—each is valuable, especially when viewed together. Their divergence tells us not just what the data say, but how different modeling philosophies interpret that story.

Used together, they give a fuller picture. If both are aligned, there may be consensus forming. If they diverge, analysts gain a cue to explore what's driving the difference—be it a swing in net exports, a change in consumer sentiment, or just methodological variance. Both are essential lenses in understanding near-term economic dynamics.

Fritz Meyer’s economics webinars keeps professionals on top of the latest tools for understanding the economics driving investment markets, which is why advisors ranked it with at least 4.7 stars out of five monthly for over a decade and it is regarded as the best IAR CE class about economics for advisors.

With AI changing the world, the best IAR CE providers are providing classes about its practical uses. Which is why this use case about AI is provided. if you agree that practical articles explaining the application of AI is the among best IAR CE classes you can find out there, please let us know and we will add classes about using AI.