In a damning assessment of the financial advice industry, the latest research by a trio of academic experts on adviser misconduct reveals that approximately 6.6% of advisers in the U.S. had a record of misconduct as of January 2024. This statistic has fueled public discourse on the trustworthiness of financial advisors. One thing not up for debate: Free IAR CE can be a powerful tool in promoting trust and deterring advisor misconduct.

The source of the 6.6% misconduct rate is an article published in the Fall 2024 issue of The Journal of Economic Perspectives, entitled “The Problem of Good Conduct among Financial Advisers,” written by Mark Egan, Gregor Matvos, and Amit Seru. This same trio in February 2016 published the first large-scale study documenting the economy-wide extent of misconduct among financial advisers.

Their findings in 2016 were shocking: 7% of advisers had misconduct records, and the share of bad conduct topped 15% at the largest advisory firms. Roughly a third of advisers with misconduct records were repeat offenders, and prior offenders were five times as likely to engage in new misconduct as the average financial adviser.

The latest study from the trio makes a case for “naming and shaming” firms to reduce repeat offenses. Their article is packed with statistical insights about the advisor industry.

“The Problem of Good Conduct among Financial Advisers,” published in fall 2024 in The Journal of Economic Perspectives reveals that, despite the increasing reliance on financial advisors—60% of households with non-retirement investment accounts used an advisor in 2019. However, they say public trust remains fragile, citing Edelman Trust Institute's 2024 study showing the financial services industry remains one of the least trusted sectors in the U.S. economy.

The distrust is not merely anecdotal. Egan, Matvos, and Seru’s work is one of the few studies to quantify the prevalence of financial advisor misconduct on a national scale. Their research shows that misconduct is systemic in certain firms and regions.

The researchers are well-qualified to lead this conversation. Mark Egan is a professor at Harvard Business School, Gregor Matvos is a professor at Northwestern University's Kellogg School of Management, and Amit Seru is a professor at Stanford Graduate School of Business.

All three are affiliated with the National Bureau of Economic Research (NBER), one of the most prestigious economic think tanks in the world. NBER scholars often contribute to shaping policy and are known for rigorous, data-driven studies.

Their latest study reveals that firms with high levels of advisor misconduct often cluster repeat offenders. Over 30% of advisors found guilty of misconduct have reoffended, and these individuals are five times more likely to offend again compared to the average advisor.

Many continue to work in the industry, however, often because consumers are ill-equipped to assess advisor quality. The authors explain that financial advice is a “credence good.” What does that mean? It is a service whose value is difficult to judge even after consumption. The "credence" aspect of the service means that the consumer must rely heavily on the advisor's reputation, credentials, and the perceived trustworthiness of the advice, rather than directly evaluating its quality based on personal knowledge or experience.

This is exacerbated by confusion in industry titles and overlapping roles, say the authors, pointing out most advisors are brokers regulated by FINRA and not held to a fiduciary standard, despite many presenting themselves as trusted professionals. The minority who are exclusively Investment Adviser Representatives (IARs) are held to a fiduciary standard always but are often lumped together with brokers in public perception.

Notably, the Egan-Matvos-Seru study largely focuses on firms with at least 100 advisors and does not delve into the world of independent RIAs, particularly those with one to 10 advisors managing $10 million to $1 billion in AUM. Many of these smaller firms operate with stronger client alignment and lower incentives for misconduct. Yet, the study’s findings cast a shadow over the entire industry, making it crucial for ethical, independent advisors to distinguish themselves.

For these smaller firms and solo practitioners, education and transparency are the best defense against public skepticism. While the authors advocate for increased disclosure and “naming and shaming” strategies to curb repeat offenses, they also emphasize the importance of enhancing consumer financial literacy. Informed clients are better equipped to select competent, trustworthy advisors and hold them accountable.

Small firms and solo practitioners are not on the radar of the authors. They ignore independent IARs unaffiliated with broker-dealers, fiduciaries with credentials. Their latest article indicates that more Americans are getting professional advice despite the high rate of misconduct and repeat offenders. The authors fail to mention the IAR CE Model Rule now effective in 22 states, which is likely to discourage misconduct among small professional financial services firms.

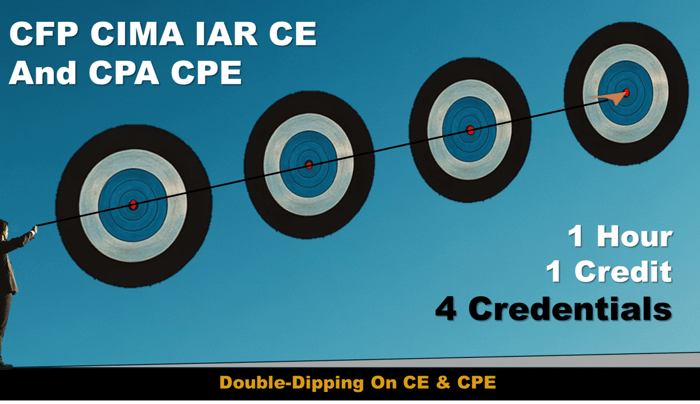

This is where Advisors4Advisors plays a key role. As an approved continuing education provider to CFP, CIMA, and CPAs for over a decade, we have deep experience in offering professionals CE and CPE webinars since the financial crisis in October 2008. In January 2025, Advisors4Advisors added free IAR CE.

Thus, not only are we educating advisors but also assisting with client education. Some of our CE content for professionals can be repurposed for advisors to educate their clients. For example, Fritz Meyer's monthly slides are available in an ongoing subscription and can be an important aide in sharing your investment perspective.

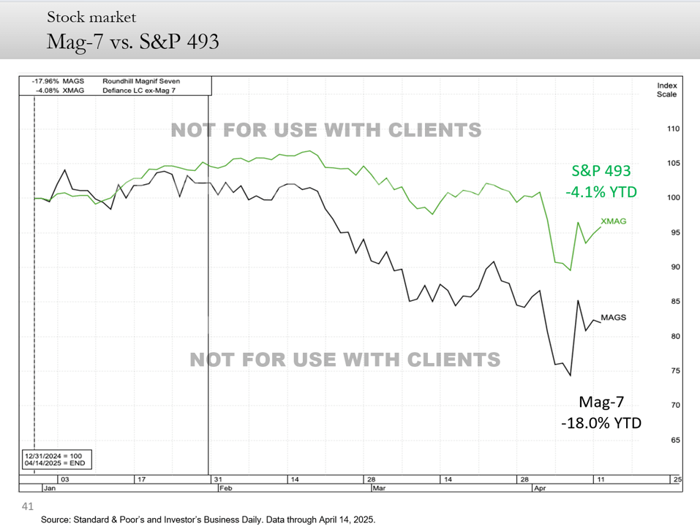

For example, the slide shown above is one of 70 in a slide deck provided with a transcript after the class. For an advisor, you get the slide plus the facts behind this important story explaining the recent stock slide. If educating clients about this builds trust, the impact of many knowledge nuggets like this is multiplied many times. which convincingly conveys trust.

Fritz Meyer, an independent economist, teaches monthly on Advisor4Advisors and this was one of about 70 slides he talked through. It shows the year to date decline in the Standard & Poor's 500 stock index, as of the closing price on April 14, 2025, was largely concentrated in the Magnificent Seven stocks -- the tech giants, which lost 18 percent of their value. The other 493 stocks in the S&P 500 lost a relative small 4.1% in the same time period. Thus, although targeting "free IAR CE" may sound like a gimmick, it is not.

We take seriously our mission to elevate ethical standards across the financial planning community. Our catalog of courses—many available as free IAR CE—helps meet regulatory requirements while enhancing the professionalism of our members.

Education is more than a box to check. It’s a vital tool for earning and maintaining trust. Courses by instructors like Dr. Frank Murtha and economist Fritz Meyer provide advisors with strategies. Their classes help advisors build emotional intelligence, empathize with client anxieties, and communicate with transparency and equip advisors with facts and evidence to support their investment outlook — all of which are essential in a profession marred by misconduct headlines.

Free IAR CE classes allow independent professionals to develop competencies that directly address the challenges identified in the Egan, Matvos, and Seru study. At a time when clients are more skeptical than ever, it’s not enough to be competent—you must also be trustworthy. And trust begins with knowledge, integrity, and a demonstrated commitment to continuous learning.

Forward-thinking advisors are using our free IAR CE not just to meet a requirement, but to raise the bar for their entire profession. The public’s waning trust in financial advisors isn’t just driven by headlines—it’s reinforced by real gaps in client-advisor alignment. As the authors explain, many clients mistakenly assume all financial professionals are bound by the same fiduciary duties.

This misunderstanding, paired with the prevalence of dual-registered professionals who switch between broker and advisor roles, makes it difficult for even discerning investors to understand who is truly acting in their best interest. It’s important to stress that the new study by Egan, Matvos, and Seru does not include data on independent Registered Investment Advisors (RIAs) operating outside the broker-dealer model. Small firms—such as those with one or two IARs and up to $1 billion in AUM—are not the focus of this research.

Many Advisors4Advisors members operate under these conditions and are always fiduciaries. For them, the misconduct statistics cited in this study may not accurately reflect their standards or culture.

Small firms—such as those with one or two IARs and up to $1 billion in AUM—are not the focus of Egan, Matvos and Seru's research. yet many Advisors4Advisors members operate under these conditions. For them, the misconduct statistics cited may not accurately reflect their standards or culture. These firms often cultivate long-term, personal relationships built on transparency and trust.

Unfortunately, the misconduct of a few high-profile advisors at national firms has cast a long shadow over the entire profession. That’s why it is more important than ever for independent IARs to differentiate themselves by committing to education and ethical standards.

With our membership fee of $60 a quarter for CFP, CIMA, and CPA practitioners staying the same, it is a privilege to provide free IAR CE.

Explore our catalog of high-quality, free IAR CE courses available on-demand and take the next step in setting yourself apart as an ethical, informed, and client-centered advisor.