Table of Contents

- NASAA-Coordinated Regulatory Reach

- Why IAR Ethics CE Rules Matter Beyond Compliance

- Origins of State Securities Regulation and Blue-Sky Laws

- How State Regulators Protect Investors in Practice

- The Value of IAR Ethics CE Rules in Modern Advisory Markets

- IAR Ethics CE Rules, Preemption, and Rising Regulatory Risk

- Advocacy for State Regulation and Investor Protection

- What IAR Ethics CE Rules Mean for Advisers Facing Preemption

- Why IAR Ethics CE Rules Ultimately Protect Trust

- FAQs

In less than three years, the North American Securities Administrators Association (NASAA) facilitated state securities regulators' nearly-flawless launch of an IAR CE regulatory program that swiftly has come to protect nearly half the nation from bad financial advisers and bad financial advice. Despite -- or, some would say, because of -- the 106-year-old association of state securities prosecutors' history of success in efficiently protecting financial consumers, NASAA and state securities regulators are now threatened by federal laws and executive orders preempting them from regulating crypto, artificial intelligence (AI), alternative assets, private placement promoters, and other risky investments using new, untested technology. The 1-credit IAR Ethics CE class I wrote is intended to help advisers understand NASAA's preemption battle, while counting toward meeting NASAA's IAR ethics CE rules requiring three ethics credit-hours annually exclusively devoted to ethics topics and not professional responsibility. The class includes practice tips on how to share information with clients, colleagues, and investors about the campaign to preempt state regulation of crypto, alternatives, private partnerships and use of AI in these financial products.

NASAA's mandatory IAR CE program and associated IAR ethics CE rules represent just one small part of the many segments of the financial services industry where NASAA plays a leading regulatory role. Look at other areas NASAA regulates:

NASAA-Coordinated Regulatory Reach

| Regulated group | Approximate number of entities / filings |

|---|---|

| Investment Adviser Representatives (IARs) | ~650,000–700,000 state-registered IARs nationwide |

| State-registered investment adviser firms (RIAs) | ~18,000–20,000 state-registered RIAs |

| Small and regional broker-dealers | ~3,000–4,000 broker-dealers registered at the state level |

| Issuers of private placements and exempt offerings | Tens of thousands of notice filings annually (Reg D, intrastate, exemptions) |

| Promoters of alternative investments and emerging assets | No fixed registry; thousands of firms and offerings monitored through filings, exams, and enforcement |

| Individuals and entities subject to state securities enforcement | Several thousand investigations and enforcement actions per year across states |

NASAA and state regulators are active in protecting financial consumers in many more segments of the financial services industry than are commonly known. NASAA's almost invisible hand in regulation seems to be by design but is also due to natural attributes, like the organization's very-forgettable and benign-sounding name. NASAA's low-profile belies its power. NASAA ethics IAR CE rules demonstrate how cleverly and quietly NASAA operates.

In requiring IARs to earn six credits annually on classes about ethics and professional responsibility, NASAA effectively upped education requirements on CFP, CIMA, and CPA financial planning and investment advice professionals. About half the nations CFPs and CIMAs who are advising individuals have had their ethics CE requirement raised 600%! And a 300% increase for CPA financial advisers. This is emblematic of the way NASAA works. No fanfare. No press release. Whoosh! Just like that. NASAA quietly redefined professional ethics education in a substantive, meaningful change to IAR ethics CE rules.

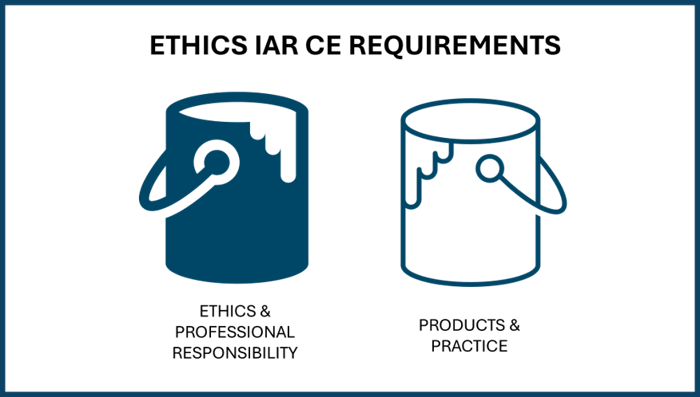

IAR Ethics CE Rules and the Launch of NASAA’s IAR CE Program

IAR ethics CE rules represent one of the most consequential regulatory changes affecting state-registered investment advisers in decades. By requiring IARs to complete 12 hours of annual education—including three hours devoted exclusively to ethics—NASAA and the states established a minimum national standard without a federal mandate. The goal was to raise baseline professionalism, deter bad actors, and reinforce fiduciary behavior. Advisers typically meet these obligations through an IAR ethics CE course designed to satisfy state requirements while addressing real-world advisory risk. The program launched in just three states in 2022 and expanded rapidly through coordinated state adoption.

Why IAR Ethics CE Rules Matter Beyond Compliance

IAR ethics CE rules matter for reasons that go far beyond satisfying a licensing requirement. They reflect a regulatory judgment that education is a frontline defense against misconduct in an increasingly complex advisory environment. Private placements, alternative investments, and digital assets often lack the transparency of public markets, placing greater responsibility on advisers to evaluate risk and explain uncertainty. By embedding ethics education into licensure maintenance, states signal that ethical awareness must evolve alongside products. Understanding IAR ethics CE requirements helps advisers align professional judgment with investor protection.

Origins of State Securities Regulation and Blue-Sky Laws

To understand why these ethics requirements exist, advisers must appreciate the historical role of blue-sky laws in U.S. securities regulation. Long before federal securities laws, markets were local and lightly supervised. Promoters sold speculative investments with minimal disclosure, leading to widespread fraud. States responded by creating registration and licensing regimes designed to protect local investors. NASAA emerged to coordinate those efforts, harmonizing standards while preserving state authority.

How State Regulators Protect Investors in Practice

State regulators remain central to investor protection, particularly in markets that federal oversight does not fully reach. Even when offerings qualify for federal exemptions, states typically retain anti-fraud authority, notice-filing requirements, and investigative powers. When investors encounter misleading disclosures or undisclosed risks, state securities offices are often the first point of contact. This is especially relevant for state-registered investment advisers operating outside large national firms.

The Value of IAR Ethics CE Rules in Modern Advisory Markets

IAR ethics CE rules are especially relevant as advisory practice increasingly moves outside traditional public markets. Private funds, alternative strategies, and emerging asset classes promise diversification but introduce regulatory complexity. State regulators understand regional issuers and community-level risks in ways national agencies often cannot. Ethics education reinforces this balance by helping advisers evaluate alternative investments regulatory risk through a fiduciary lens.

IAR Ethics CE Rules, Preemption, and Rising Regulatory Risk

IAR ethics CE rules now sit directly in the path of expanding federal preemption efforts. Proponents argue that uniform federal standards simplify compliance and foster innovation. However, preemption often removes local oversight mechanisms that detect early-stage fraud. This increases reliance on advisers’ own processes when recommending private placements and fiduciary duty intersect under reduced regulatory supervision.

Advocacy for State Regulation and Investor Protection

A broad coalition of consumer-advocacy, civil-justice, and investor-protection organizations has mobilized to defend state securities authority. These groups warn that preemption would reduce transparency, accountability, and local enforcement. Ethics education aligns advisers with state securities regulation as a cornerstone of fiduciary responsibility.

What IAR Ethics CE Rules Mean for Advisers Facing Preemption

IAR ethics CE rules take on heightened importance as preemption proposals advance. Reduced state oversight shifts responsibility onto advisers to verify disclosures, evaluate issuer credibility, and explain regulatory gaps to clients. Clear understanding of due diligence responsibilities of IARs becomes essential as regulatory safety nets weaken.

Why IAR Ethics CE Rules Ultimately Protect Trust

IAR ethics CE rules ultimately exist to protect trust—the trust clients place in advisers and markets. State regulation has protected investors for more than a century by combining local insight with coordinated enforcement. By reinforcing ethical standards and regulatory awareness, these rules help ensure innovation does not outpace accountability. For advisers, embracing them is a strategic commitment to long-term credibility and client confidence.

FAQs

What are IAR ethics CE rules?

IAR ethics CE rules require investment adviser representatives to complete annual, NASAA-approved ethics education focused exclusively on ethical conduct and professional responsibility.

Why did NASAA create IAR ethics CE rules?

NASAA created IAR ethics CE rules to raise baseline professional standards, deter misconduct, and strengthen investor protection at the state level.

How many ethics credits do IARs need each year?

Under the NASAA model rule, IARs must earn three ethics credit-hours annually as part of six total CE credits.

How do IAR ethics CE rules affect CFPs, CPAs, and CIMAs?

Credential holders who are also IARs face substantially higher ethics CE requirements than those imposed by their professional organizations alone.

What does federal preemption mean for IAR ethics CE rules?

Federal preemption could limit or eliminate state authority to require ethics education and enforce related investor-protection standards.

Why are state securities regulators important to investors?

State regulators handle licensing, local enforcement, and fraud detection, especially for private placements and alternative investments.

How do IAR ethics CE rules support fiduciary duty?

IAR ethics CE rules reinforce transparency, due diligence, and client-first decision-making when regulatory oversight is under pressure.