Table of Contents

- NASAA’s Quiet 600% Shock to CFP® Ethics Training

- Framing The Issue

- 2025 NASAA Ethics IAR CE Is A Game Changer

- Three Years of Regulatory Change With No Coverage

- Why CFP® IARs Face a 600% Ethics Increase

- The Consumer Impact of 2025 NASAA Ethics IAR CE

- How the Model Rule Creates a Universal Minimum Standard

- 2025 NASAA IAR Ethics CE Is Reshaping Ethics Training for Professionals

- Why Advisors Find 2025 NASAA Ethics IAR CE More Meaningful

- What CFP Board, IWI, and NASBA Could Not Accomplish — And the Role of A4A

- FAQs

NASAA’s Quiet 600% Shock to CFP® Ethics Training

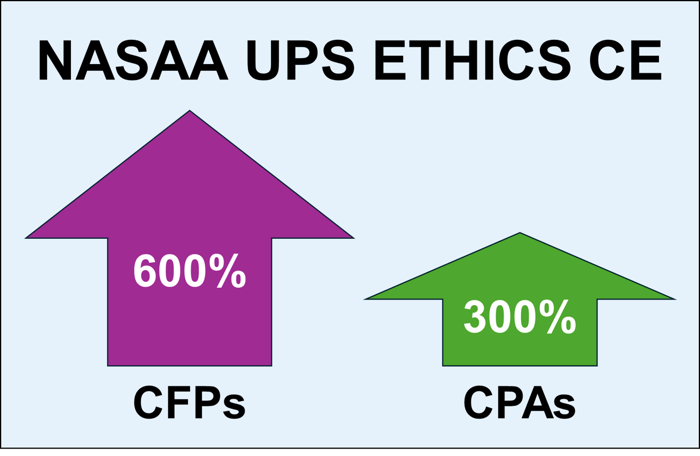

The regulatory transformation surrounding the 2025 NASAA Ethics IAR CE regime has occurred with almost no public awareness, despite imposing the largest ethics‑training increases in U.S. advisory history. CFP® practitioners who are also IARs now face a 600% increase in required ethics CE, while CPA IARs face a 300% increase. Advisors4Advisors reviewed five years of FT, NYT, and WSJ online headlines and discovered zero reporting on this sweeping shift. Yet this change strengthens consumer protection and elevates professional standards across the industry.

Framing The Issue

This video below provides rich context for understanding the dramatic increase in ethics training the IAR CE rule imposes on nearly half of the nation’s IARs. Once you grasp why the system is changing, meeting IAR CE requirements becomes more meaningful, easier to engage with, and even satisfying. The full video is rightfully called "the best IAR CE course for Investment Adviser CE compliance."

2025 NASAA Ethics IAR CE Is A Game Changer

The 2025 NASAA Ethics IAR CE model rule requirements has succeeded where CFP Board, IWI, AICPA, and NASBA could not. It establishes a mandatory national minimum standard for ethics and professional responsibility across all IARs. For the first time, every advisor—credentialed or not—must meet the same baseline ethics requirement. This uniformity enhances transparency and strengthens consumer confidence in advisory professionalism.

Three Years of Regulatory Change With No Coverage

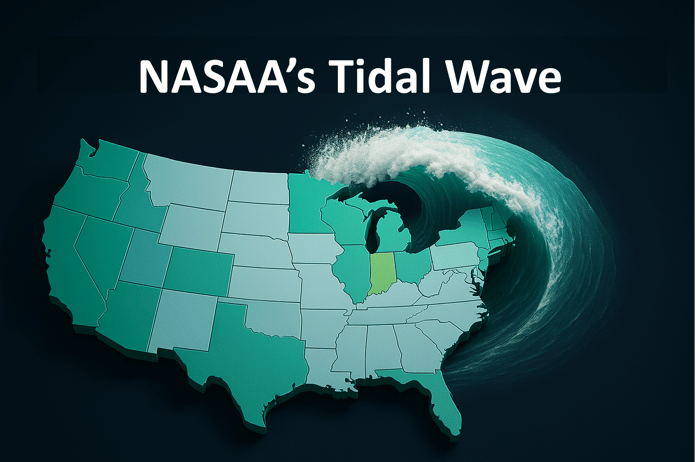

Over the past three years, state after state adopted the NASAA model rule. Today, 23 states have adopted the model rule, fundamentally reshaping education requirements for all IARs and hiking ethics training sixfold for CFPs. Despite the massive impact of protecting nearly half of all Americans, no major financial publication published a single headline on the subject. Advisors4Advisors confirmed this by reviewing five years of FT, NYT, and WSJ archives. This silence has left many advisors unaware of the magnitude of the change until they confront their annual CE obligations.

Why CFP® IARs Face a 600% Ethics Increase

The 2025 NASAA Ethics IAR CE rule requires every IAR to complete six hours of ethics and professional responsibility each year. For CFP® practitioners who are licensed to give investment advice by state registered IARs under NASAA's model rule, this represents a sixfold increase in their annualized ethics requirement. Because 2020 NASAA ethics IAR CE requirements are tightly tied to fiduciary conduct, conflicts, disclosures, and compliance, this creates a rigorous, consistent ethics education structure across financial advisory professional designations. CPA ethics CE varies by state and historically focused on accountancy rather than investment‑advice. The 2025 NASAA ethics IAR CE rules compare to an annual requirement imposed on CPA financial advisors of two hours. NASAA strives to make its IAR CE requirements uniform with those imposed on on CFPs, CIMAs, and CPAs. However, the huge disparity in ethics training requirements is likely by design.

The Consumer Impact of 2025 NASAA Ethics IAR CE

For consumers, 2025 NASAA Ethics IAR CE is a transformative development. For the first time since the first financial investments were made in ancient Mesopotamia, 4,000 or 5,000 years ago, financial consumers know their advice is coming from someone whose been subject to a battery of tests required by the government.

For the first time, financial consumers have a reason to trust their financial advisors because their advice is now grounded by a credible minimum standard requiring 12 hours of education annually, with six hours devoted entirely to ethics and professional responsibility.

The IAR CE requirement is a major step in creating profession for financial advisors. It implements a continuing education system akin to the licensing education required of doctors, lawyers and other types of professionals.

By creating a baseline for professional growth enforced by state regulators. The clarity strengthens trust and helps protect investors. Of course, a crook can hire someone to take 12 classes, but that’s a hassle. The alternative is for a crook to spend 12 hours to learn the content. This is not what hardened criminals want to spend their time doing. The IAR CE requirements, thus, are a credible deterrent to crooked or unserious investment advisors.

Half of the nation's financial consumers can now trust that their advisor keeps current on best practices in dispensing financial advice and knows about the latest regulations. IARs subject to NASAA's model rule must earn 12 credits a year to maintain their status as an IAR registrant.

How the Model Rule Creates a Universal Minimum Standard

The model rule is intentionally simple: six hours of ethics and six hours of products and practices each year. This straightforward design makes the standard easy for regulators to enforce. It also creates a uniform standard across thousands of RIAs and IARs. The result is the first coherent national educational baseline in the 84‑year history of U.S. advisory regulation.

2025 NASAA IAR Ethics CE Is Reshaping Ethics Training for Professionals

NASAA’s mandatory annual ethics requirement for IARs far exceeds the obligations imposed by CFP Board, IWI, and AICPA/NASBA. CFA Institute imposes no mandatory ongoing ethics CE at all. By showing the effective annualized ethics obligations of each body, this table highlights how NASAA has accomplished what no voluntary credentialing organization could do for decades: create a uniform, regulator‑enforced minimum standard that applies to every investment adviser representative in states where NASAA’s model CE rule is enacted.

Organization | Mandatory Ethics Requirement | CE Cycle |

CFP Board | 2 hours | Every 2 years |

IWI (CIMA) | 2 hours | Every 2 years |

AICPA/NASBA (CPAs) | 4 hours | Every 2 years |

CFA Institute | 0 hours (no mandatory CE) | N/A |

NASAA IAR CE | 6 hours | Annually |

*Note: CFP Board and IWI ethics requirements are on a two‑year cycle but effectively average 1 hour of ethics per year. AICPA/NASBA requirements average 2 hours per year. CFA Institute imposes no mandatory CE; all CPL/SER guidance is voluntary.*

Why Advisors Find 2025 NASAA Ethics IAR CE More Meaningful

Many advisors report that NASAA‑approved CE feels more relevant and practical than previous CE frameworks. The coursework addresses real‑world challenges, including fiduciary lapses, AI‑related compliance risks, product‑selection pitfalls, and client‑communication issues. The context provided in the video above helps advisors view IAR CE with a clearer sense of purpose and postivity, making the learning experience more rewarding and impactful.

What CFP Board, IWI, and NASBA Could Not Accomplish — And the Role of A4A

Professional organizations have long attempted to elevate advisory standards, but as voluntary membership bodies, they cannot impose universal requirements. NASAA, through coordinated state regulation, can—and did. The 2025 NASAA Ethics IAR CE requirements represent an enforceable national ethics baseline for financial advisors. Advisors4Advisors has led the industry in analyzing the rollout and creating CE formats that align with NASAA’s standards while respecting advisors’ time and need for high‑quality, journalism‑based instruction.

FAQs

What is the 2025 NASAA IAR CE requirement?

The 2025 NASAA IAR CE requirement mandates that all investment adviser representatives complete 12 hours of continuing education annually, including 6 hours of ethics and professional responsibility and 6 hours of products and practices. This is the first universal CE standard applied across IARs and is now enforced by state regulators.

Why did the 2025 NASAA IAR CE rule increase ethics training by 600% for CFPs?

Because CFP® professionals previously averaged 1 hour of ethics per year, the NASAA requirement of 6 annual ethics hours represents a 600% increase. NASAA’s model rule creates a uniform, regulator-enforced ethics standard that applies to all IARs, not just those holding voluntary designations.

How does the 2025 NASAA IAR CE rule impact CPAs who are IARs?

CPAs typically averaged 2 hours of ethics every two years, or 1 hour annually—but NASAA now requires 6 ethics hours per year, a 300% increase. This aligns CPA-IAR ethics training with fiduciary obligations under state securities laws.

Why is the 2025 NASAA IAR CE considered a major change for consumers?

For the first time in history, financial consumers can assume their IAR completes mandatory annual ethics and practice training. Previously, many IARs had no ethics CE requirement at all. The new rule strengthens trust, accountability, and baseline professionalism across the advisory industry.

Does the 2025 NASAA IAR CE replace CFP Board, IWI, or AICPA ethics rules?

No. Advisors must still meet the requirements of CFP Board, IWI, or AICPA/NASBA if they hold those credentials. NASAA’s rule adds a separate, mandatory, regulator-approved ethics requirement that applies to every IAR in participating states—regardless of what designations they hold.

Which states require the 2025 NASAA IAR CE, and are more expected to adopt it?

A growing number of U.S. states — including several large jurisdictions — have adopted the NASAA IAR CE rule, and more have implemented it each year since it launched in 2022. Advisors should confirm requirements with their own state securities regulator, because adoption varies and is not yet nationwide. While no future adoptions beyond Illinois (effective 2026) have been announced, the regulatory infrastructure built around IAR CE indicates that it is becoming an increasingly common standard among state securities regulators.

How many states are expected to enact the law in 2026?

Illinois is expected to make the NASAA's model IAR CE rule effective in 2026, according to NASAA.