Why This Is The Best IAR CE In July 2025

Financial professionals are facing a rapidly changing economic landscape. Inflation is easing, but deficits, demographic shifts, and productivity trends present new challenges and opportunities. For Investment Adviser Representatives (IARs), CFPs, CPAs, CIMAs, and CFAs, staying ahead requires more than just fulfilling continuing education requirements. It demands high-level, data-driven context. That’s why this month’s update from economist Fritz Meyer is arguably the best IAR CE program of the summer of 2025.

Resilient Growth: GDP, Jobs, and Productivity

The July 15th, 2025 session highlights how the economy continues to confound skeptics. According to the Atlanta Fed, GDP growth for Q2 is tracking at 2.6%, beating many earlier projections. The long-term trend of 2.3% GDP growth still holds, underpinned by solid productivity improvements. Meyer highlights that U.S. worker productivity has grown at an average of 2.1% over the past five years, far outpacing the previous decade. This is crucial because it means the economy can grow faster without overheating—a key insight when advising clients on long-term allocation strategies.

Meanwhile, the labor market remains healthy. The BLS reported 147,000 net new jobs in June, with wage growth at 3.7% year-over-year, comfortably ahead of the 2.3% PCE inflation rate. Even though the unemployment rate ticked down to 4.1%, there are still 7.8 million job openings versus just 7 million job seekers. This “excess demand” for labor is an important buffer against economic slowdowns.

Consumers, Seniors and the Wealth Effect

One of the most powerful themes from the July update is the resilience of U.S. consumer spending, driven heavily by seniors. According to the latest data from the Census Bureau and Labor Department, Americans aged 65 and older now account for 22% of total spending, a record high. This demographic holds over half of U.S. household net worth, and with many retirees mortgage-free and enjoying stable income streams, their spending remains strong. Meyer called this the “secret weapon” of the U.S. economy—a force that continues to drive GDP despite higher interest rates.

In addition, household net worth is well above its long-term 5.8% trendline, thanks to gains in both equities and real estate. Consumers are also managing their debt responsibly. Revolving credit as a percentage of disposable income is stable, and household debt service payments remain historically low, meaning Americans are not financially strained. Banks report that consumers are still spending, backed by solid balance sheets.

Stock Market Valuations & Earnings Outlook

For advisors helping clients navigate market volatility, July’s IAR CE session offered critical data. The S&P 500 is trading at a forward P/E of over 22, high by historical standards, but not without justification. Earnings expectations are robust: estimates for S&P 500 operating earnings in 2026 have jumped to $300 per share, a 14% increase over 2025 and nearly double the historical growth rate of 7.5%.

Meyer emphasized the importance of staying fully invested. Trying to time recessions often backfires, as the market typically bottoms months before the economy does. The data also shows the equity risk premium remains intact: over the past 30 years, the S&P 500 has delivered total returns of around 10% annually, comprised of 7.9% earnings-driven price appreciation and 2.1% from reinvested dividends.

Deficits, Debt and Why Tax Hikes Are Coming

The fiscal outlook, however, is less rosy. The new One Big Beautiful Bill Act is expected to push U.S. debt-to-GDP to 127% by 2034, compared to 117% without the bill. The Congressional Budget Office’s latest projections show federal deficits averaging about 6% of GDP over the next decade. With Social Security’s trust fund set to run out by 2033, big tax hikes are almost inevitable.

In fact, the Wall Street Journal recently warned that maintaining Social Security and Medicare will require either cutting benefits by up to 26% or raising the payroll tax to nearly 17%. Given that most Americans would prefer higher taxes to reduced benefits, advisors should prepare clients for an environment of gradually rising tax burdens. Meyer pointed out that even with tax increases, the U.S. would still be below the overall tax-to-GDP ratios seen in countries like Germany and France, suggesting there’s fiscal room to maneuver.

Why This Is The Best IAR CE Class Right Now

What sets this CE program apart—and makes it the best IAR CE this month—is its integration of macro data, market fundamentals, and practical client considerations. It’s not just about passing an exam for continuing education credit. It’s about equipping financial professionals with a framework to discuss complex issues like productivity, demographic spending patterns, stock valuations, and the fiscal future in a way that resonates with clients.

Advisors who can confidently explain why higher deficits might lead to tax hikes, why seniors’ spending helps stabilize GDP, or why staying invested matters even in high P/E environments will stand out. Clients want advisors who understand more than just portfolio rebalancing—they want guidance that weaves together economics, taxes, and personal goals.

In addition, Advisors4Advisors the best IAR CE because it is remarkably affordable compared to competitors offering continuing education for investment professionals. Many CE providers charge up to $500 annually, A4A’s membership is $60 a quarter, or $240 on an annual bases. This includes unlimited access to live and on-demand webinars covering CFP®, CPA, CIMA®, and IAR CE requirements.

Members also get expert-driven economic and investment updates by respected analysts like Fritz Meyer and industry specialists.

Beyond CE credits, A4A delivers exceptional practice management insights tailored for fee-only advisors. Its low cost, paired with high-quality content and regulatory compliance, makes A4A an outstanding value. Simply put, A4A offers comprehensive professional education and support at a fraction of typical industry prices, helping advisors grow without straining their budgets.

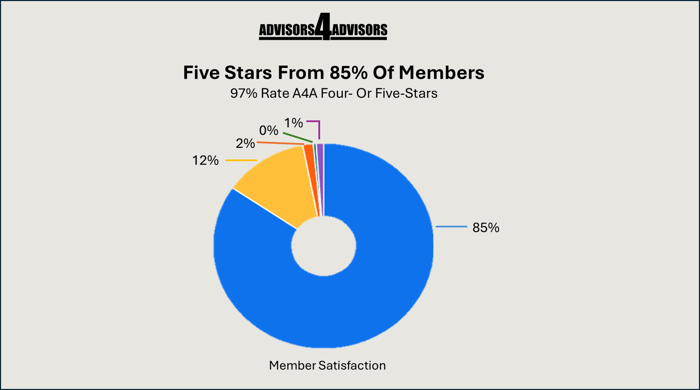

Advisor CE Satisfaction Ratings In 2025

This chart reflects that Advisors4Advisors classes get among the best IAR CE ratings from advisors, according to publicly available data. Every member rating Advisors4Advisors has received from members after classes so far in 2025 is shown in this chart. A remarkable 85% gave classes five stars! Another 12% rated classes with between four stars and five. An amazing 97% of advisors rated classes with either four or five stars!

These ratings validate our commitment to providing the best IAR CE. Financial advisors rely on A4A for CE and CPE that's not just compliant but also immediately valuable in real-world practice. If you're looking for a provider with consistently top-tier user satisfaction, Advisors4Advisors delivers the best IAR CE based on real ratings from users.

Final Takeaway

If you’re searching for the best IAR CE, CFP CE, or CPA continuing education option that does more than check a box, this program is it. With a data-rich, forward-looking approach, it prepares you to deliver context that keeps clients invested and confident through whatever market or policy changes come next. That’s value far beyond CE compliance—and exactly what will keep your practice thriving in the years ahead.

Learn more and access upcoming sessions at Advisors4Advisors.com.