In the wake of April’s economic updates, financial professionals—from CPAs and CFPs to Investment Adviser Representatives (IARs), CIMAs, and CFAs—are facing an economic environment marked by unprecedented unpredictability. Welcome to Tariff War CPA CPE which also earns CFP, CIMA, and IAR CE credit. The imposition of new tariffs on April 2nd triggered what’s now being called “Liberation Day”—a dramatic stock market sell-off that grabbed headlines and raised recession fears. Highlights of the analysis from Fritz Meyer's Tariff War CPA CPE class are summarized: Mixed Signals: Tariffs, Jobs, and Market Reactions

The most visible tremor was the market’s initial reaction. Stocks fell hard, driven largely by declines in the Magnificent Seven mega-cap stocks. But outside those household names, the S&P 493 has been relatively resilient. This isn’t a traditional bear market—yet. Instead, it's a sector-specific pullback compounded by uncertainty over trade policy. Importantly, many institutional forecasts have only modestly trimmed their corporate earnings expectations, and P/E ratios have corrected to more reasonable levels.

The PMI Picture: Flatlining Growth?

The ISM Manufacturing PMI dropped to 49.0 in March, signaling contraction in the manufacturing sector. Meanwhile, the ISM Services PMI hovered just above the contraction level at 50.8. These are not numbers that point to a booming economy, reports the Tariff War CPA CPE class by economist Fritz Meyer, but they also don’t confirm a hard stop. Services make up nearly 90% of the U.S. economy, and their marginal expansion suggests a slow-growth environment rather than an outright recession.

Housing, Construction, and the U.S. Growth Engine

One of the most surprising positive signals covered in the Tariff War CPA CPE class of April 2025 came from housing. Housing starts surged from 1.3 million to 1.5 million in February. Construction employment is at record highs, and aggregate construction spending—across residential, non-residential, and public projects—has hit unprecedented levels. With a national housing shortage of 4.5 million units, as estimated by Zillow, there’s reason to believe housing will remain a powerful economic tailwind.

A Labor Market That Defies Gravity

This Tariff War CPA CPE class shows March job gains of 228,000 confirmed continued labor market resilience. Real wage growth remains strong: average hourly earnings grew 3.8% year-over-year while CPI inflation cooled to 2.4%, producing net real income gains. The unemployment rate remains low at 4.2%, and crucially, job openings still exceed the number of job seekers—suggesting continued strength in employment.

Boomers, Balance Sheets, and the Wealth Effect

Demographics are playing an underappreciated role in economic resilience. Boomers—ages 61 to 79—own over half of U.S. household wealth. They are less reliant on credit, more financially secure, and increasingly represent a major share of consumer spending. In 2024, Americans aged 65+ accounted for 22% of consumer expenditures, a historic high. For a Tariff War CPA CPE class this is good news., This wealth effect is helping to keep demand robust despite market jitters and concerns about inflation. Household balance sheets remain solid, with debt service ratios and revolving credit as a percentage of income at historically sustainable levels. Contrary to media hype about consumer overextension, most Americans—especially higher earners—remain well-positioned to maintain current spending levels.

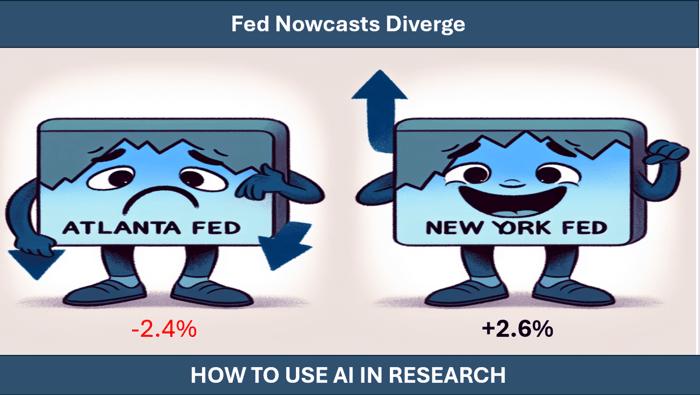

Diverging GDP Forecasts: Who’s Right?

Institutional economic forecasts vary wildly. The Atlanta Fed’s GDPNow model predicts a 2.4% contraction for Q1 2025, while the New York Fed forecasts 2.6% growth. Read our AI-aided comparison of the two Fed branch algorithms, using ChatGPT’s Deep Research tool is here. The Wall Street Journal’s April survey shows a sharply downgraded consensus for Q1 but maintains expectations of continued growth. The Conference Board projects real GDP growth around 2.0% for the full year.

Long-Term Investing: Earnings Still Matter

No tariff war CPA CPE class would be complete without a reminder that the long-term drivers of stock market returns remain earnings and dividends. Earnings for the S&P 500 are forecasted to grow from $245 in 2024 to $305 in 2026. P/E multiples have come down from 22 to under 20, reflecting market recalibration rather than structural weakness. Historical data continue to support the case for long-term equity investing. Stocks have compounded at approximately 10% annually over the last 90 years—a remarkable engine of wealth creation.

Active vs. Passive: SPIVA Says It All

For advisors counseling clients on strategy, Fritz Meyer closes his Tariff War CPA CPE class with the latest data from SPIVA, which remain unequivocal. Over the last 20 years, 94.11% of active fund managers underperformed their benchmarks. While active strategies may show short-term flashes of outperformance, the overwhelming evidence supports passive, index-based investing as the superior long-term strategy.

Conclusion: Clarity in Complexity

Advisors navigating today’s economic environment must reconcile short-term market volatility with long-term economic resilience. Tariffs may continue to roil markets and stir headline anxiety, but the data—jobs, housing, wages, and consumer balance sheets—suggests the U.S. economy remains fundamentally sound. For CPAs, IARs, CFPs, CIMAs, and other financial professionals, these are critical insights not just for portfolio strategy, but for demonstrating thought leadership to clients in uncertain times. Learn and Earn CE

This post summarizes a continuing professional education class and shows the kind of analysis you get on Advisors4Advisors. Stay informed, stay strategic, and remember, amid the near-term storm, fundamentals still matter and try to keep that concept in your vision of the future. Fritz Meyer, an independent economist, has taught on A4A monthly since March 2011. His monthly classes averaged a rating of 9.7 (out of 10) annually year after year. Before teaching on A4A, Fritz was senior strategist at one of the world's largest investment companies for over a decade. Since mid-2011, A4A members consistently rated Fritz Meyer’s CE/CPE presentations higher than 4.7 (out of five stars) every month. He has no product affiliations, and his classes are solely member-sponsored CE/CPE Fritz Meyer's April 2025 class is a one-hour course followed by our failproof guarantee. If you pay attention, we guarantee you'll pass the assessment. The Learning Experience On Advisors4Advisors, meeting IAR education requirements is simple. A navigation bar on the left side of your browser guides through the five sections of every class : - Instructions

- Video presentation by instructor

- Engagement exercise

- Scored assessment

- Satisfaction survey

Want more insights like this? Explore our library of IAR CE, CPA CPE, and CFP CE classes designed to keep you informed—and ahead.

|