With the bond and stock markets responding to jobs data and GDP surprises, this interim update from Fritz Meyer breaks down recent numbers, identifies trends and discusses future economic implications. This blog post summarizes Fritz's thoughts as of May 4, 2025 and integrates relevant charts to provide insights. If you're looking for the best live CFP CE content, this update demonstrates just that.

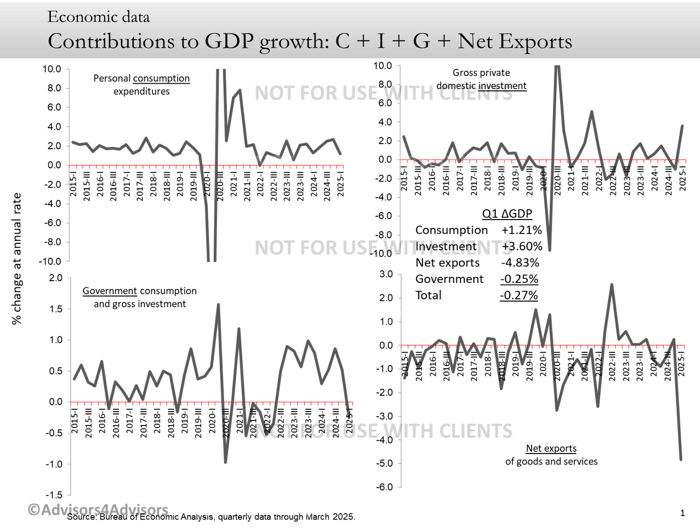

| The first quarter GDP report showed a contraction of -0.2%. However, Fritz Meyer explains in this update that this figure masks underlying strength in consumer demand. A surge in imports—triggered by businesses racing to buy before tariffs—negatively impacted net exports, which in turn dragged down GDP. The GDP formula (C + I + G + Net Exports) highlights how a spike in imports can severely offset gains in consumption and investment. Economists expect this effect to be temporary, predicting a rebound in Q2. A recession, which is defined as two consecutive quarters of economic shrinkage, thus, remains unlikely. | Fritz Meyer Webinars Fritz Meyer's webinars deliver vital updates that financial professionals use to understand economic events, earnings, and market volatility. Fritz Meyer's next class offering live CFP, CIMA, CPA and IAR education credit is on Tuesday, May 13, 2025, at 4 p.m. EST. It's free to members of Advisors4Advisors. If you are not a member of Advisors4Advisors, join here If you are a member, you are already registered for the class. To find the registration confirmation, search your inbox for an email from [email protected] with the subject, "Live Fritz Meyer Economic Update, May 2025 Confirmation." If you did not receive it, then you do not have have an account on our platform, which was upgraded in January 2025 and now enables free IAR CE and on-demand CPA CPE webinars. While CFP, CIMA, and CPA credit are earned with no scored exam, earning IAR CE credit does require passing an assessment by scoring at least 70%. Assessments on Advisors4Advisors are easy to pass. |

Forecast Confusion Highlights Market Uncertainty

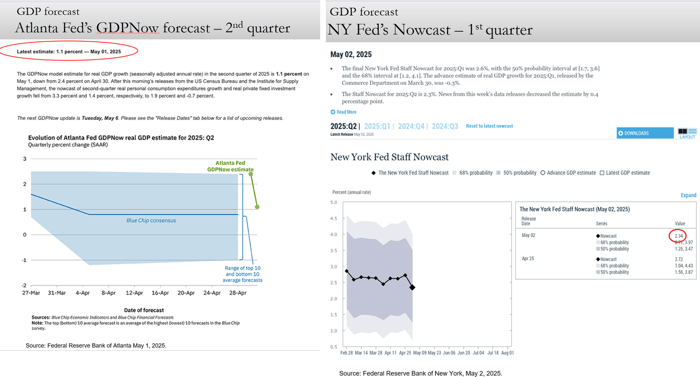

Forecasts from top institutions vary widely. The Wall Street Journal’s April survey shows economists lowering their projections significantly since January, yet still anticipating moderate growth. CNBC’s Rapid Update shows a Q2 rebound to 1.6%, while the Atlanta Fed’s GDPNow model predicts just 1.1%. In contrast, the NY Fed’s Nowcast is more optimistic at 2.3%. This dispersion signals how tariffs and volatile trade dynamics complicate traditional models. For advisors seeking best live CFP CE updates, understanding these disparities is critical to providing context to clients.

Consumer Spending Drives Growth – Best live CFP CE

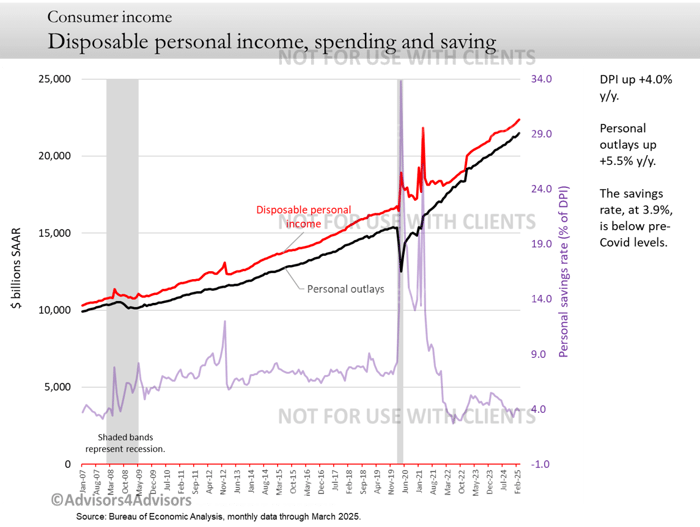

Despite GDP weakness, consumers continue to spend. Personal outlays increased 5.5% year-over-year, outpacing inflation (2.3%) and delivering real growth in consumption. Disposable personal income rose by 4%, and although the savings rate fell to 3.9%, it remains above pandemic lows. These figures reaffirm Meyer’s point: consumer strength is the backbone of the U.S. economy. This insight is vital for CFPs seeking practical, data-driven perspectives in the best live CFP CE sessions.

(Insert Slide: Disposable personal income, spending and saving)

(Insert Slide: Disposable personal income, spending and saving)

Jobs and Inflation: A Balancing Act

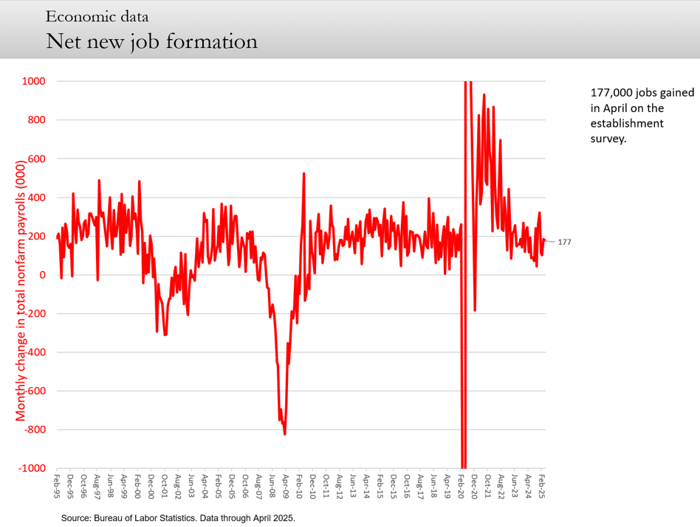

April’s job report added 177,000 new positions, pushing markets higher. Wages grew 3.8% year-over-year, comfortably outpacing inflation. Importantly, wage growth is decelerating, reducing inflationary pressure. The unemployment rate held steady at 4.2%, indicating the U.S. is at or near full employment. Meyer notes that with this tight labor market, adding large numbers of manufacturing jobs may be unnecessary and potentially inflationary.

Labor Market Tight But Balanced – Best live CFP CE

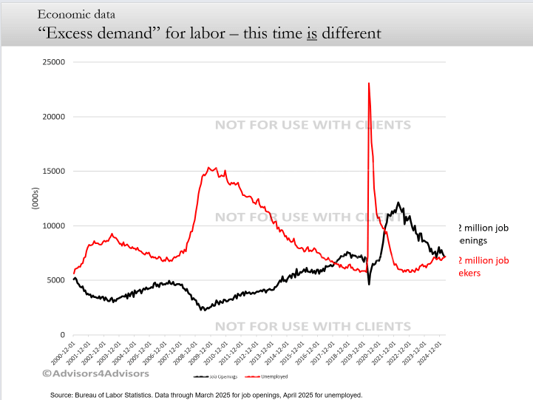

Job openings fell to 7.2 million—down from over 10 million—but remain equal to the number of unemployed. Historically, there are more job seekers than openings, so this equilibrium remains favorable. This scenario underscores the strength of the labor market and supports Meyer’s optimism about continued consumer spending.

The GDP Equation and Tariff Volatility

Fritz Meyer's breakdown of the GDP equation was one of the most illuminating parts of the presentation. By revisiting the formula—GDP equals consumption (C), investment (I), government spending (G), and net exports (exports minus imports)—he illustrated how macroeconomic reports can be misinterpreted without proper context. In Q1 2025, a surge in imports triggered by anticipated tariffs skewed the data. Import activity detracted nearly 5% from overall GDP, overpowering the positive contributions from consumer and business spending. Meyer emphasized that this phenomenon is not reflective of a weakening economy but rather a short-term distortion. This insight is especially useful for professionals who rely on accurate narratives in client discussions or financial planning decisions. Such economic nuance exemplifies why this session is among the best live CFP CE opportunities available.

Dissecting the Forecast Models

The broad divergence between forecast models highlights how challenging it is to predict short-term economic performance during times of uncertainty. The Atlanta Fed's GDPNow model, for instance, anticipated a weak Q1 performance at -1.6%, closer to the actual -0.2% figure than other estimates. Meanwhile, the NY Fed’s Nowcast was more optimistic, projecting over 2% growth. This divergence underscores the limitations of econometric modeling in real-time, particularly when new variables—like geopolitical trade tensions—enter the equation. For CFP professionals seeking the best live CFP CE content, these contrasting forecasts serve as a reminder that understanding assumptions behind models is just as important as interpreting their output.

Why Real Wages Matter More Than Ever

Amid inflation concerns, one of the most reassuring economic trends Meyer highlighted was the continued growth in real wages. With inflation settling at 2.3% and wage growth at 3.8%, the American consumer is experiencing a meaningful increase in purchasing power. This data contradicts some pessimistic media narratives and signals long-term stability. When clients ask about their ability to sustain spending during inflationary periods, pointing to wage gains is both reassuring and evidence-based. This is a critical takeaway for any CE curriculum and reflects the depth that defines the best live CFP CE programs.

Navigating Full Employment

One of the more controversial observations from Meyer came when he questioned the need for new job creation, particularly in manufacturing. With the unemployment rate at 4.2% and job openings matching unemployed workers one-for-one, we’re effectively at full employment. Meyer posited that pushing for massive job creation in such an environment could be inflationary, as it risks creating a labor shortage. This insight challenges conventional political narratives and urges financial advisors to think critically about employment data when advising clients on career transitions, retirement timing, or business expansions.

Final Thoughts – Staying Grounded Amid Uncertainty

Although GDP contracted in Q1, underlying indicators such as jobs, wages, and spending remain robust. The economic outlook is clouded by trade uncertainty and unusual variables like tariff effects, but consumer fundamentals remain strong. For those looking to stay ahead and earn the best live CFP CE credit, Fritz Meyer’s insights offer a reliable guide through economic complexity.

The overarching theme in Meyer’s presentation was one of cautious optimism. While the economic landscape is undoubtedly complex, driven by anomalies like tariff-related trade distortions and disparate GDP forecasts, the fundamentals—consumer spending, real wage growth, and job creation—remain strong. This is a time when fear takes hold and reactions can be counterproductive. For CFPs and other financial professionals, the ability to decode this complexity into actionable client guidance is invaluable. Sessions like this not only provide professional education credit but also clarity—making this among the best live CFP CE experiences currently available.